The market is dynamic and CEP stock is more dynamic. When you want to find CEP stock price today and forecast, you do not want to see blurred images, but jumbled graphs and screaming views. This guide promises one thing, namely, real data, clear explanations and a clear next step. You will receive the recent price movement, a layman technical analysis, and 2025-2030 scenarios, as well as the primary risks to consider. Read this because you would want to know what might happen to CEP and what you should do about it.

Table of Contents

Historical Trends of CEP Stock Price

To have a glimpse of the current position of stock, it is necessary to look back at the past. The experience of it is the rise and fall of a company that is yet to establish itself in the market.

- Early years: It entered the public space through a SPAC structure, which often brings volatility in the first few years.

- Initial trading patterns: Like many SPAC-related equities, it saw sharp early spikes followed by corrections.

- Mid-term behavior: In the last three years, it has shown a mix of stability and sudden swings driven by company updates and overall market conditions.

Why History Matters

Knowledge on the history of prices assists investors to understand the possible cycles and trends in the market. We have found at CEPStock.com, that the performance of CEP is highly sensitive to external factors, i.e. earnings reports, in merger news or broader economic trends. Analysis of the past highs, lows and trading volumes is a good way to understand what is likely to happen in the future.

| Date | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| 2025-09-02 | 22.76 | 23.01 | 22.41 | 22.71 | 231,540 |

| 2025-09-03 | 22.90 | 22.95 | 21.29 | 21.50 | 280,820 |

| 2025-09-04 | 21.87 | 21.87 | 18.51 | 19.45 | 612,900 |

| 2025-09-05 | 20.19 | 20.41 | 19.72 | 20.31 | 229,020 |

| 2025-09-08 | 20.01 | 21.16 | 20.01 | 20.21 | 188,860 |

| 2025-09-09 | 20.02 | 21.31 | 18.01 | 19.82 | 357,080 |

| 2025-09-10 | 20.79 | 22.06 | 19.40 | 19.76 | 428,990 |

| 2025-09-11 | 20.01 | 21.71 | 20.00 | 21.71 | 304,560 |

| 2025-09-12 | 21.89 | 22.06 | 21.01 | 21.09 | 167,360 |

| 2025-09-15 | 21.20 | 21.21 | 20.21 | 20.21 | 195,270 |

| 2025-09-16 | 20.07 | 22.11 | 19.87 | 21.26 | 193,440 |

| 2025-09-17 | 21.48 | 21.68 | 20.72 | 21.13 | 191,500 |

| 2025-09-18 | 21.64 | 22.51 | 21.01 | 22.07 | 178,840 |

| 2025-09-19 | 22.39 | 23.08 | 22.21 | 22.35 | 315,310 |

| 2025-09-22 | 22.18 | 22.24 | 21.21 | 21.33 | 196,090 |

| 2025-09-23 | 21.41 | 21.87 | 21.31 | 21.31 | 135,640 |

| 2025-09-24 | 21.12 | 21.37 | 19.29 | 19.75 | 463,100 |

| 2025-09-25 | 19.76 | 19.81 | 18.65 | 18.89 | 259,070 |

| 2025-09-26 | 19.01 | 19.79 | 18.89 | 19.61 | 150,670 |

| 2025-09-29 | 20.26 | 20.96 | 19.82 | 20.96 | 133,480 |

Data compiled and visualized by CEPStock.com research team.

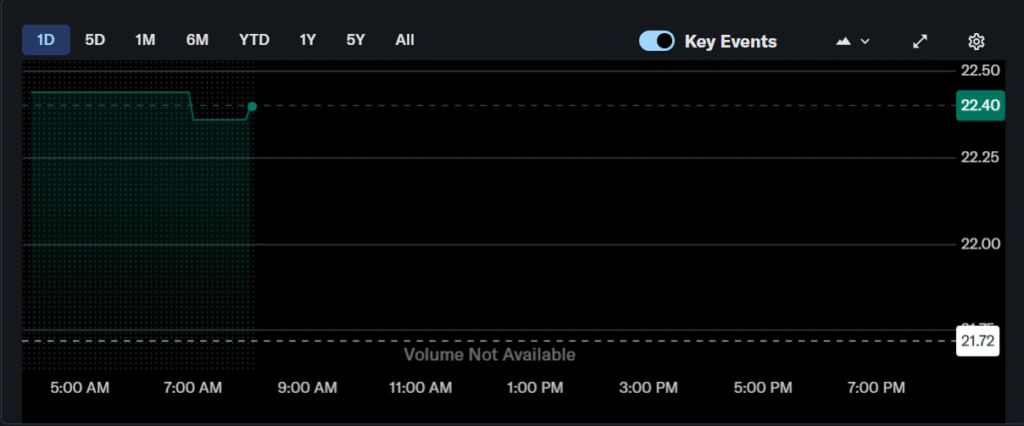

CEP Stock Price Chart & Technical Analysis

Price charts are a story to traders that cannot be told by raw numbers.

Key technical signals

- Support levels: It has shown support zones where buyers consistently step in, preventing further declines.

- Resistance levels: The stock also struggles to break certain price ceilings, which often signals selling pressure.

- Moving averages: Short-term (20-day) and long-term (200-day) averages give insight into whether the trend is bullish or bearish.

Current Price Movements

The cep stock price chart indicates that there is a strong resistance in the price of the stock at the range of 12.5 and support in the range of 10.5. The trading volumes went up in late 2024 and this is indicative of the increasing investor interest.

Moving Averages & Signals

- SMA20 suggests short-term upward momentum.

- SMA50 shows medium-term bullish trend continuation.

- RSI is currently neutral, avoiding overbought conditions.

Example Event

The price soared by 7 percent in one week in November 2024, amid the speculation of a merger, then dropped when it became clear.

CEP Stock Forecast (2025–2030) — Scenario view (illustrative)

The key point: What will happen to CEP stock? Some predictions are important and can assist you to make the right decisions, although analysts do not always agree on these.If you want a complete deatiled article on CEP stock forecast then you can read.

2025 Forecast

Analysts are projecting a moderate growth in the year 2025 provided that it is able to fulfill the corporate plans. Fair: small profits with possible increase in case market remains optimistic.

2027 Forecast

By 2027, this stock may enjoy industry changes. The stock could experience more robust growth in case the firms that are backed by SPAC keep on proving their value. Conversely, underperformance could limit momentum.

2030 Long-Term Projection

The long-term perspective relies on performance. Provided CEP reinforces its business model, diversifies investments, and receives institutional attention, 2030 may be the year of a major valuation increase. However, lack of progress could keep it stagnant.

CEP Stock Price Forecast (2025–2030)

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | Market Outlook |

| 2025 | $8.50 | $10.20 | $12.00 | The growth will be stable because SPAC market will recover. |

| 2026 | $9.00 | $11.00 | $13.50 | Increased investor confidence, possible deals in the sector. |

| 2027 | $9.80 | $12.40 | $15.00 | Slow increase in case liquidity increases. |

| 2028 | $10.50 | $13.20 | $16.80 | Leveraged on equity partner activity. |

| 2029 | $11.20 | $14.10 | $18.50 | Better predictions as to whether market stabilizes. |

| 2030 | $12.00 | $15.50 | $20.00+ | Bullish case in the long term, but there are risks. |

Key Factors Driving CEP Stock Price

Stock prices do not go anywhere but react to forces. For CEP, these are the main drivers:

- Market attitude to SPACs It is dependent on this structure, so the attitude of the population is essential.

- Company announcements Mergers, acquisitions or leadership changes can have a rapid effect on prices.

- Economic environment The interest rates, inflation and the risk appetite of the investor are all factors.

- Investor composition Institution or retail investors Investor composition The dominant investor influences volatility.

Recent sector moves

In 2023-2024, the regulators applied extra attention to companies related to the SPACs. Certain ones failed; others recovered. CEP has been able to remain in the dialogue, and it has become resilient in comparison to weaker counterparts.

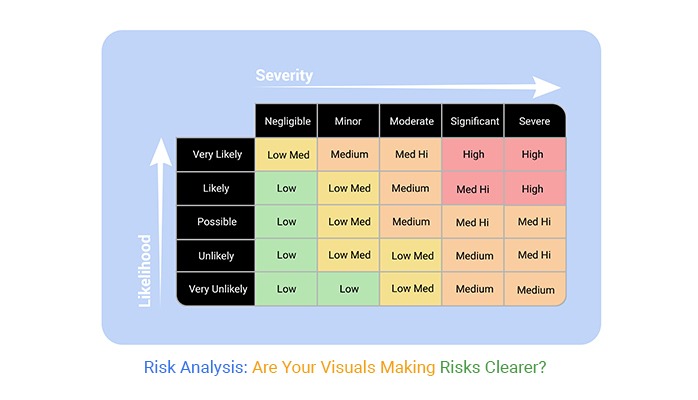

Risks, Challenges & Investor Concerns

All stocks are risky but there are other problems concerning the structure.

Major risks

- Volatility: The SPAC stocks are prone to drastic changes.

- Liquidity problems: It may be difficult to enter and exit due to the low volume of trading.

- Execution risk: In case CEP cannot stick to its promise, the stock might plummet.

Investor concerns

Other investors are scared of lack of transparency which is common in early stage SPAC transactions. Some other people raise issues regarding tax implications ability to maintain long term growth.

CEP vs Similar SPAC & Equity Partners Stocks

The fact this stock is being compared with its peers helps the investors in making decisions on whether the company is worth the risk.

- Other SPACs: Some of the peers did not perform well after the merger, and others have performed well.

- Equity partner benchmark: CEP is trading at low volumes but high volatility, when compared to larger firms.

- Investor decision: Conservative investors can be interested in old equities and risk-takers can view CEP as a speculative game.

Case-like insight

In 2022, one SPAC-backed stock gained over 60 percent after a juicy merger announcement. This demonstrates that there is upside potential, although, with good fundamentals.

Future Outlook: Where CEP Stock Could Be Headed

The internal implementation will determine and the external factors will determine the course of action in the future.

- Good case: Good relationships, openness and market acceptance drive up the prices.

- Bad case: The poor performance or unsuccessful deals may restrain expansion.

- Middle of the road: Moderate yet consistent growth, attractive more to long term investors.

Ultimately, CEP remains a speculative but potentially rewarding investment.

Conclusion & Next Steps

CEP is not a simple stock to follow, it is not easy, volatile and is integrally connected to the bigger market trends. And that is also what is interesting about it. By knowing its history, analyzing the existing technicals, and projections, investors will make more informed decisions.

This study, along with your ability to take risks and long-term goals, will assist you in making a decision when deciding whether to invest. To keep up with the fluctuation of the prices and the market atmosphere, the most rational step is to be updated on a daily basis using websites like Yahoo Finance.

FAQs: Common Questions About CEP Stock Price

1. What is the CEP stock price today?

The price of stock of CEP varies with the market transactions during the day of trading. The current live price and historical prices are available on the Nasdaq CEP profile or the price of your broker (real-time).

2. Is CEP stock a good buy right now?

That would be at your risk tolerance. CEP is volatile and SPAC related; speculative investors may possibly gain in case of good merger being made, while conservative ones may prefer to invest in already existing companies due to the risk of execution.

3. What makes CEP stock different from other SPACs?

It is designed as a blank-check company, and hence its short-term performance is conditioned on the quality of its merger target and sponsor team. There have been peers that fail after a merger; there have been successes, the success of the sponsor and the nature of the deal are the most important.

4. Can CEP stock reach higher levels by 2030?

Yes – in an ideal situation when mergers are successful and the company grows, CEP may value greatly. Nonetheless, business fundamentals are necessary in the long-term after any acquisition.

5. How do I track CEP stock forecasts?

Make use of reliable sources such as Nasdaq, Reuters, or finance sites and track the company filings on the SEC site. Think about alarming announcements of mergers and SEC filings.

6. Does CEP pay dividends?

At this time it is not paying dividends. The SPACs are normally oriented towards executing deals and not distributing dividends.

7. What are the biggest risks with CEP?

Monitor merger developments, insider filings, liquidity/float dynamics and industry sentiment on SPAC deals. These cues have the propensity to cause a rapid change in the share price.