CEP stock is also gaining more attention in the equity market, and this is drawing the attention of investors all over the world. As its industry continues to show increasing demand and a dynamic trading background, both retail and institutional investors are posing the same question that is “where will CEP stock be in 2025, 2026 or even 2030?”

Making a prediction of the price of a stock is not regarding the prediction of a single value. It is more about being able to know the market trends, investor mood and technical indicators to prepare both positive and negative results. In this paper, we are going to explore the CEP stock forecast 2025-2030 in detail, including the short-term and long-term forecasts, the technical analysis, risks, and growth prospects.

Table of Contents

Introduction: Why CEP Stock Forecast Matters (2025–2030)

The usefulness of stock forecasts is that they allow investors to have realistic expectations. CEP stock forecast 2025 – 2030 is important to long-term investors who will be interested in determining whether the stock will increase by double, triple, or suffer in the coming decade.

Retail investors, more especially, would like to know:

- Will CEP stock be $100 or even 500 in 2030?

- Is CEP stock a good investment in long term?

- What are the threats that may affect the growth of the stock?

These are not only questions of curiosity, but they assist traders to deal with risk and make investment plans.

CEP Stock Forecast for 2025

It is anticipated that the year 2025 will be the spring board of CEP growth by the mid-decade. Analysts project more trading because institutional investors have intervened.

CEP Stock Forecast by Month (2025)

| Month | Min Price ($) | Avg Price ($) | Max Price ($) | Potential ROI |

| Oct 2025 | 23.6 | 40.93 | 51.19 | 1.1893x |

| Nov 2025 | 48.88 | 50.32 | 54.92 | 1.3491x |

| Dec 2025 | 55.63 | 71.21 | 81.22 | 2.4739x |

Short-Term Predictions (Next 5 Days)

Short term CEP stock price can be volatile. The weekly movements will range between $22-26, depending on the general trend of the market. Provided the buying momentum continues the following month, CEP would be able to increase to $30.

| Date | Prediction ($) | Potential ROI |

|---|---|---|

| Nov 06, 2025 | $30.00 | 0.290 |

| Nov 07, 2025 | $31.50 | 0.365 |

| Nov 10, 2025 | $33.00 | 0.440 |

| Nov 11, 2025 | $34.50 | 0.515 |

| Nov 12, 2025 | $36.00 | 0.590 |

Forecasts sourced from CEPStock.com — for informational purposes only. Always verify live quotes and consult a licensed advisor.

In the 6-month horizon, analysts predict that CEP will trend to the 40-50 range, aided by a rise in the fundamentals and sector expansion.

Full-Year Outlook (Min, Avg, Max)

| Year | Min Price ($) | Avg Price ($) | Max Price ($) |

| 2025 | 23.6 | 54.15 | 81.22 |

This article is purely informational and does not amount to financial advice. Forecasts are projections that are made using models and past data. Never make your investment decisions without checking live prices and consulting a licensed financial advisor.

Also read: CEP Stock Price Today & Forecast (2025 Update) for the latest daily price trends and analysis.

The 2025 long-term projection indicates that there is a potential of almost a tripling of the value of CEP relative to its present values. This growth will be based on stable incomes, positive market news and investor mood.

CEP Stock Forecast for 2026

With the maturity of CEP, the year 2026 can be more stable than the 2025 volatile growth.

Month-by-Month Predictions

| Month | Predicted Range ($) |

| Jan–Mar 2026 | 45–52 |

| Apr–Jun 2026 | 50–60 |

| Jul–Sep 2026 | 55–65 |

| Oct–Dec 2026 | 60–77 |

The projection is that CEP will achieve a potential high of $77 by the year 2026 provided that external market conditions are favorable.

Potential ROI Analysis

A shareholder that purchased CEP shares in 2024 at 23 dollars will realize a 200-250 percent ROI in 2026. That is why CEP is a good choice of medium-term investors.

CEP Stock Forecast for 2027

The year 2027 may prove a significant year to CEP since the stock will have a better trading history.

Expected Growth Trends

There is a possibility that by 2027, the growth will be slightly slowed with prices falling between 41-60. This is a normal consolidation following a high growth rate over the years.

Bullish vs Bearish Scenarios

- Bullish case: The stock is pushed to $60+ by institutional investors.

- Bearish case: Competition and profit-taking make CEP draw towards $40-45.

It could be the “year of correction” and then CEP will rise in late 2020s.

CEP Stock Forecast for 2028

In the case of CEP stock forecast in 2028, the analysts see a moderate growth with average prices of about 41-45, but only in the absence of economic head winds.

Bullish In a bullish market, CEP may move to $45-50 by strong mergers and sector tailwinds, whereas a poor global market may squeeze the profits.

Long-Term Investment Sentiment

2028 sentiment could be mixed. Certain investors will consider CEP as a long-term hold whereas other investors might want to take short-term chances with the emerging competitors.

Market Volatility Factors

Economic changes such as inflation, interest rate increase or technological regulation may have a heavy burden on cep stock prediction 2028. It is projected that the average price will be $41.26, and the downside risk is in the event of a slow down in the global markets.

CEP Stock Forecast for 2029

One of the most expected years in the forecast is 2029. The analysts are of the view that this may be the year that CEP gets its way through key psychological levels.

Will CEP Reach $100?

Under bullishness, the prices may climb to $113.73.

Risk vs Reward in 2029

Although it is exciting to cross over the 100 mark, there are risks involved. Gains could be curtailed by market corrections or world recessions. Highs should not be pursued without risk management strategies by investors.

CEP Stock Forecast for 2030

The big question: What will CEP stock be worth in 2030?

Long-Term Growth Outlook

By 2030, CEP will be averaging at $83.86, and the bullish targets will be above 106. This implies that investors who have invested since 2025 will have returns of 300 percent or more.

Is CEP a Good Buy for the Next 5 Years?

CEP stock has a good growth story to long term investors. The 2030 prospects are also bullish even at volatile times, hence it is a good stock to diversify in portfolios.

CEP Stock Forecast by Year (2025–2030)

| Year | Min Price ($) | Avg Price ($) | Max Price ($) | Potential ROI |

| 2025 | 23.6 | 54.15 | 81.22 | 2.4739x |

| 2026 | 45.64 | 59.96 | 77.46 | 2.3133x |

| 2027 | 41.74 | 49.87 | 60.42 | 1.5845x |

| 2028 | 35.28 | 41.26 | 45.5 | 0.9461x |

| 2029 | 29.6 | 43.39 | 113.73 | 3.8645x |

| 2030 | 63.97 | 83.86 | 106 | 3.5336x |

Methodology: Forecasts here combine historical price trends, moving-average signals, volatility metrics, and scenario modeling (Bear / Base / Bull). Numbers are model outputs and represent possible ranges, not guaranteed outcomes. For live price confirmation, verify the CEP quote on Yahoo Finance

Technical Analysis Insights

For live quotes and to verify moving averages or intraday charts, check CEP on Yahoo Finance.

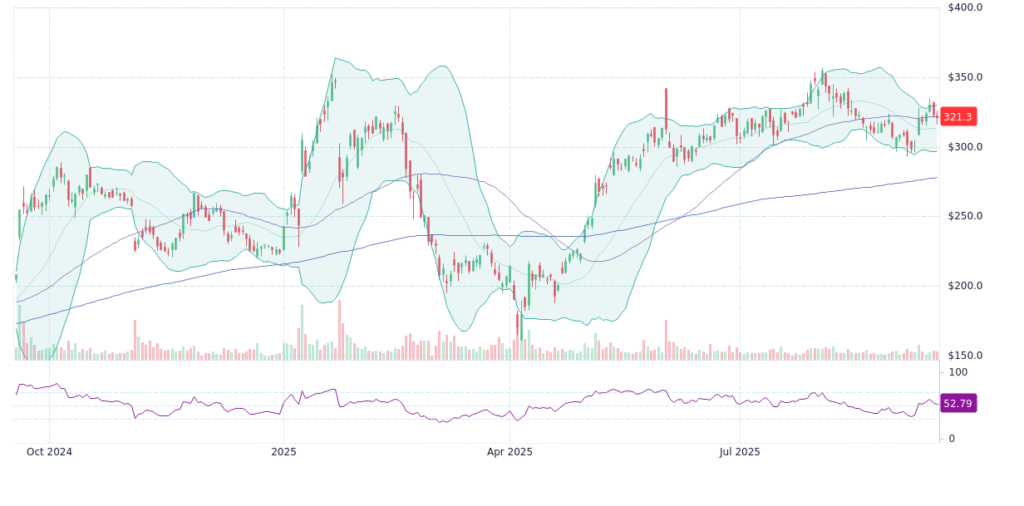

RSI & Volatility Index

- RSI (14-Day): 57.88, near neutral.

- Volatility Index: Medium risk, the stock can have fluctuations, but has an upside.

These are some indicators that indicate that CEP stock is neither overbought nor oversold and thus a balanced point of entry.

| Indicator | Value | Action |

| 50-Day SMA | $24.20 | SELL |

| 200-Day SMA | $21.48 | BUY |

| 14-Day RSI | 57.88 | Neutral |

| EMA 3 | $23.38 | SELL |

| EMA 10 | $21.45 | BUY |

| EMA 200 | $23.37 | BUY |

| Fear & Greed Index | 39 | Fear |

Bullish and Bearish Scenarios Explained

- Bullish scenario: CEP will surpass $100 in 2029, as the industry expands and the company gains high earnings.

- Bearish case: Prices become stagnant at $40-50 in case the global growth becomes sluggish or CEP performs poorly compared to the peers.

- Neutral scenario: The company will continue to grow steadily to around $70-85 by 2030 and will satisfy patient shareholders.

| Year | Bullish Target ($) | Bearish Target ($) | Neutral Avg ($) |

| 2025 | 81.22 | 23.6 | 54.15 |

| 2026 | 77.46 | 45.64 | 59.96 |

| 2027 | 60.42 | 41.74 | 49.87 |

| 2028 | 45.5 | 35.28 | 41.26 |

| 2029 | 113.73 | 29.6 | 43.39 |

| 2030 | 106 | 63.97 | 83.86 |

Final Thoughts: Should You Buy or Hold CEP?

The stock forecast cep 2025- 2030 indicates that this stock has colossal upside potential. Early entrants would be able to multiply their investments. Nevertheless, one should not disregard such risks as market volatility, regulation and competition.

CEP stock is a good candidate to be held by long-term investors who are not in a hurry. The people having shorter horizon ought to monitor technical levels and control entry points.

CEP stock is a high potential/moderate risk stock- a stock that should be followed closely in the coming years.

Frequently Asked Questions (FAQ)

What will CEP stock be worth in 2025?

CEP stock may be at an average of $54 by 2025 and above 80 in case of bullish action.

Will CEP stock reach $100 or $500?

According to some models, CEP could hit over $100 in a bullish 2029, although it is unlikely to hit over $500 in ten years, without an extraordinary growth of the company. Regard long-term numerical goals as very hypothetical.

Is CEP stock a good investment long-term?

Yes, the long-term potential is forecasted to be strong. By 2030, CEP has the potential of yielding returns of 3-4x.

What factors will affect CEP stock price in the future?

The most important ones are the demand in the market, the world economy, competition, regulations and investor sentiment.

Should I buy CEP stock now?

With a long-term perspective, the now levels are a good point of entry. Buying cep should be awaited by short-term traders.