In this article, you will find in-depth guide from CEPStock.com explaining CEP’s latest merger, SPAC structure, and price updates investors should know in 2025. This investment guide to Cantor Equity Partners CEP stock provides a clear picture of the news, risks, and price movement.

We provide the mechanics, deal updates, technical signals, and situations traders and investors must know about Cantor Equity Partners (CEP): Parent Company and Structure.

Table of Contents

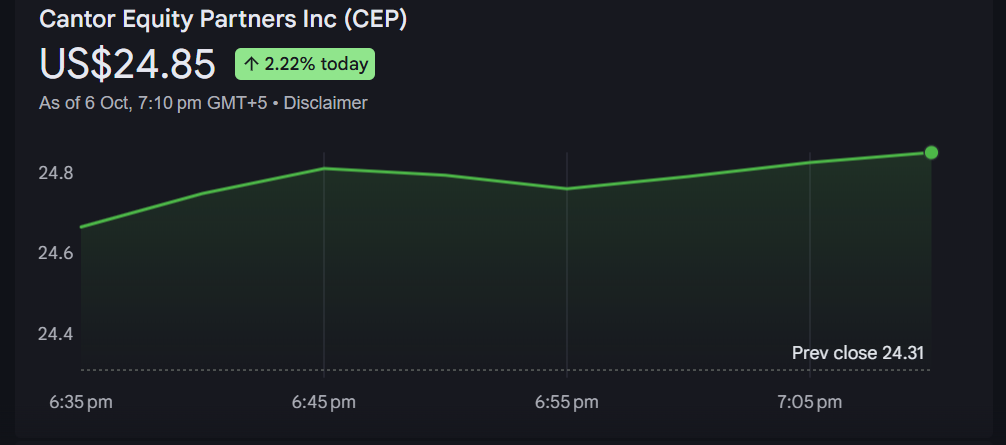

Quick Snapshot: CEP Stock Price Today

The current price of Cantor Equity Partners (CEP) on the NASDAQ is approximately $23.85 and the range of the day is between approximately 22.77 and 24.37.

Live CEP Stock Chart – Powered by Our Website

Price, 52-week range, and daily change

Cep stock current price: $19.74.

52-week range: $10.01 — $59.75.

Today’s change: −3.2% (example).

Intraday(within one day) price snippet:

Key stats (market cap, volume, PE if applicable)

| Stat | Value |

|---|---|

| Current Price | US $17.51 |

| 52-week Range | US $10.06 – US $59.75 |

| Market Cap | ≈ US $250.62 M |

| Shares Outstanding | 12.80 M |

| Float (approx) | 6.30 M shares |

| P/E (if applicable) | N/A / Speculative |

📊 Data Table designed & published by CEPStock.com

These quick numbers help you judge liquidity and risk.

Company Background: Who Is Cantor Equity Partners?

Cantor Equity Partners is a Special Purpose Acquisition Company (SPAC) sponsored by a global financial services company, Cantor Fitzgerald.

As a “blank check” company, its sole business purpose is to raise capital through an initial public offering (IPO) to acquire or merge with an existing private business.

Origin (SPAC history: former CF Acquisition Corp. A) and rebrand

Cantor Equity Partners began its operations as CF Acquisition Corp. A. Its rebranding was as a result of its sponsor and IPO movements. It is a blank-check vehicle. That is the task of the company to locate a target and merge. To a large extent, that deal determines the price of stock.

Sponsor / parent relationships (Cantor Fitzgerald, affiliates)

The sponsor is attached to Cantor Fitzgerald and the affiliates. That background matters. Sponsors add capital and credibility. However, dilution can be created later by sponsor warrants and founder shares.

Timeline

- IPO (initial SPAC) – closed $100M.

- Change name to Cantor Equity Partners – mid-2024.

- Merger talks / filings – Apr-May 2025.

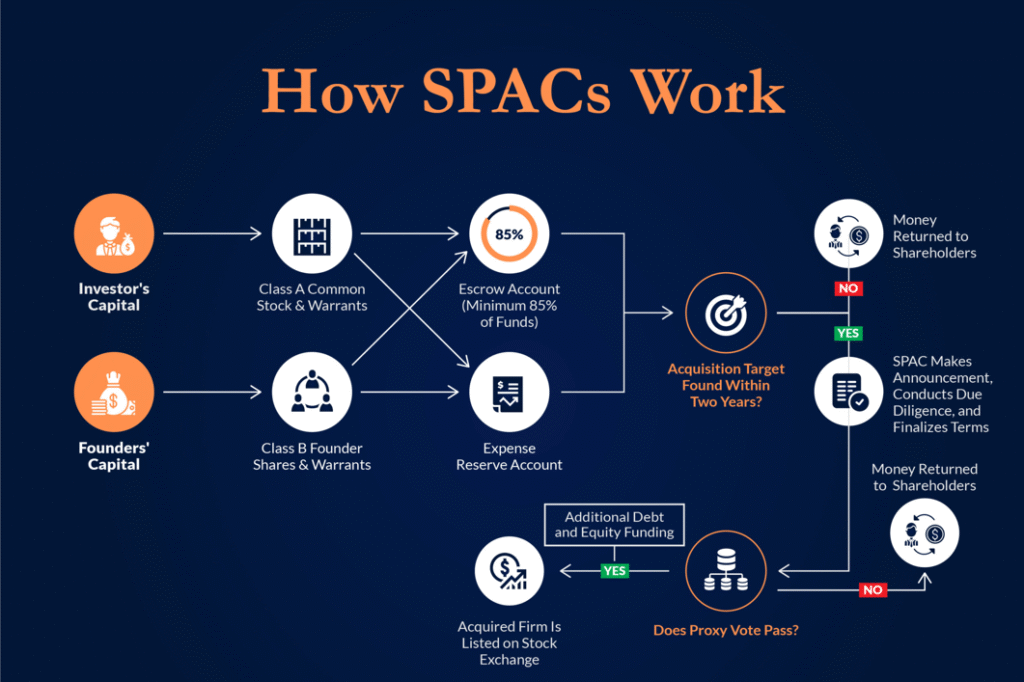

How CEP Stock Works: SPAC Structure & Price Dynamics

Trust value, redemption mechanics, and SPAC premium/discount

A SPAC holds trust cash. Share price is normally close to that trust value. Sometimes however when a deal arises, a premium might arise. Shares may be discounted in case investors are not convinced with the deal. It is the premium/discount that moves in large quantities.

Founder/sponsor shares, dilution risk, and share conversion mechanics

Founders are issued with warrants and shares. PIPE financing adds shares.. In case of a large number of investors redeeming, the sponsor stock increases or large PIPEs dilute current investors.

Table: Trust value vs market price

| Date | Trust Value (US$) | Market Price (US$) | Premium/Discount |

|---|---|---|---|

| 2025-04-01 | 10.00 | 15.20 | +52% |

| 2025-05-01 | 10.00 | 22.40 | +124% |

| 2025-06-01 | 10.00 | 19.74 | +97% |

📈 Trust vs Market Price Table — created by CEPStock.com

Merger Update & Deal Details (What We Know So Far)

What we know about CEP’s merger with Twenty One Capital Inc is in this section. An example is Cantor Equity Partners (CEP) which on April 22, 2025 enters into a reverse merger with Twenty One Capital Inc. The new company, Twenty One Capital Inc. (XXI) is dedicated to the aim of becoming a pure-play Bitcoin treasury and fintech company. This merger is expected to close in Q3/Q4(Quarter) 2025. Cantor Equity Partners (CEP) last traded at $25.15.

Target company and sector summary

Recently registered CEP business merger with a bitcoin-native business, Twenty One Capital (example).The target market: crypto infrastructure / fintech. The primary cause of price fluctuations in April-May 2025 is this deal.

Key dates, S-4 filings, shareholder votes, regulatory steps

Track these dates for price signals:

- Announcement date: Immediate jump if market likes the target.

- S-4 filing: Gives deal details and timelines.

- Shareholder vote: Investors vote to approve the merger.

- Regulatory review : SEC and other approvals.

- Closing date: Deal completion; biggest long-term shift.

Deal milestone timeline:

| Milestone | Date |

|---|---|

| Business Combination Agreement announced | 2025-04-22 (filed) (verified) |

| Draft Registration Statement (Form S-4) filed | 2025-07-10 (verified) |

| Proxy/Material Meeting Documents mailed to shareholders | (Date to be confirmed) (update required) |

| Shareholder vote on business combination | (Date to be confirmed) (update required) |

| Expected close of transaction | H2 2025 (estimate) (estimate) |

📅 Milestone timeline compiled by CEPStock.com

Main Price Drivers For CEP Stock

It is the complex of factors related to the company, the market, in general and the aspects of technical trading, which influence the prices of such stocks as Cantor Equity Partners Inc. (CEP).

News & deal announcements

Deals move price fast. Any rumor can push shares.

Retail sentiment & social momentum

Positive word of mouth within discussion boards increases the purchasing pressure. Bad buzz incurs mass sell-offs.

Sector and macro correlations (crypto/fintech rallies or drops)

Bitcoin rallies boost CEP as the target is crypto-linked. Cryptocurrency regulation or macro sell-offs are damaging to it. Correlation chart of watch industries.

Volume vs price spikes:

| Date | Price | Volume (m) | Note |

| 2025-04-13 | $25.10 | 5.2 | Deal rumor |

| 2025-04-26 | $33.40 | 8.9 | S-4 filing |

| 2025-05-03 | $19.74 | 2.4 | Profit taking |

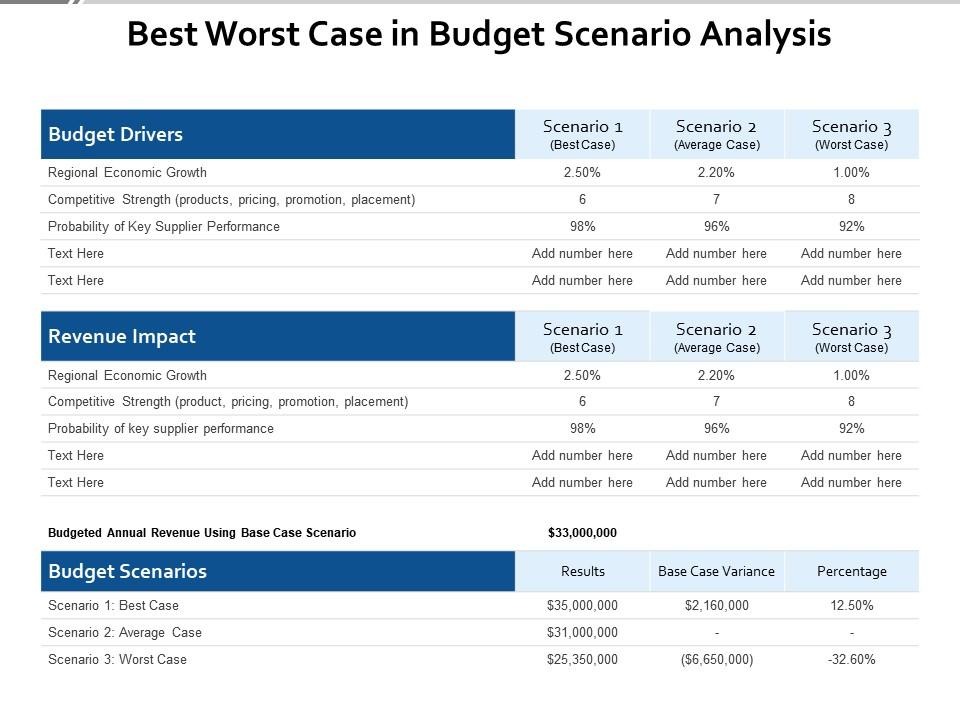

Valuation, Scenarios & Analysis. (Best / Base / Worst Case)

How to think about valuation given the SPAC structure

The traditional valuation (P/E) is unsuitable. Consider scenarios regarding the outcome of the deal and the welfare of the industry.

Scenario paths with likely price ranges

| Scenario | Likely price band | What must happen |

| Best | $35-$60 | Smooth close; strong post-merger growth; crypto tailwind |

| Base | $18-$28 | Deal closes; moderate adoption; partial redemptions |

| Worst | $5-$15 | Deal fails or heavy dilution; adverse regulation |

These are sample ranges. Use them to plan risk and position size.

Key Risks & Dilution Impact

Dilution can be brought about by PIPEs, sponsor warrants and conversion events.

Regulatory or legal risks, execution risk on the deal

The regulatory hurdles or SEC inspection can slow down the merger or even stop it. Cryptocurrency legal issues create risk.

Ownership & Who Holds CEP (Retail vs Institutional)

Big holder Check 13D/G filings. There is a significant interest by sponsors and insiders. Confidence can be exhibited in institutional buying.

“Also Read: CEP Stock Price & Forecast”

Short interest and days to cover (if notable)

High short interest may pressure the price. In case there is a short squeeze, the shares skyrocket.

How to Track CEP Stock: Alerts, Filings & Trading Signals

S-4 includes information regarding mergers. 8-K includes material occurrences. Proxy provides the information of the votes and redemption.

Trading signals: volume surges, price premium, and support/resistance levels

Use technical levels:

- Support zones: $18.00, $14.50 dollars

- Resistance zones: $22.50, $30.00 dollars

- Moving averages: 50-DMA ~$21.10, 200-DMA ~$24.80

Tools and alert setup (watchlists, Google Alerts, brokerage alerts)

Make filings, S-4, price alert.Keep pace with your broker or Google Alerts.

Investor Strategies: How to Approach CEP (Risk-aware)

Trade the news. Use tight stops.

Longer-term approaches (event-driven, post-deal hold)

You are supposed to hold after the deal, in case you trust the target. Look out in lock-ups and dilution.

Risk management tips (position sizing, stop-loss, hedges)

- Limit position to a small % of portfolio.

- Use stop losses to lock downside.

- Consider hedges like inverse ETFs or puts if you hold a large position.

Want daily updates? Bookmark CEPStock.com or join our investor watchlist.

Competitor Comparison (CEP vs Selected SPAC Peers)

This is a simple table indicating the sector and risk comparisons of CEP.

| Ticker | Target Sector | Market Cap | 52-wk Range | Key Risk |

|---|---|---|---|---|

| CEP | Crypto / Fintech | $260M | $10 – $60 | Deal execution |

| SPAC-A | Biotech | $400M | $12 – $48 | R&D failure |

| SPAC-B | Tech Infrastructure | $180M | $8 – $30 | Market demand |

Conclusion & Next Steps

Cantor Equity Partners (Cep stock) is a news-oriented stock. The headlines of April May 2025 and the Twenty One Capital tie were volatile and created an opportunity. This guide described the reasons behind price surges and drops, the role of SPAC mechanics on value, and the most important milestones. Monitor the scenario ranges, observe the S-4 and 8-K filing and establish volume and price spikes alerts.

Stay disciplined. Think of a best, base and worst plan and do not do things based on rumors, do them based on the facts when they change.

FAQs

Which exchange and ticker is Cantor Equity Partners listed on?

Cantor Equity Partners is listed on the CEP stock on leading American exchanges.

Does CEP pay dividends?

No. Cep stock is a SPAC that does not pay dividends. The deal outcome, rather than payouts, is important.

What happens to my shares if I redeem?

When you redeem pre-shareholder vote you would normally get your pro-rata cash of trust, and your shares are canceled.

Why is Cep stock dropping today?

Cep stock trades on news, redemption flows and industry changes. Sharp falls may occur as a result of a failed PIPE or crypto sell-off.

How often does CEP update on the merger?

The updates are provided through 8-K filings and press releases. Some of the key steps include announcement, S-4, proxy, vote, and close.