Explore CEP stock short interest, data, and market information to drive trader sentiment. Get to know how short squeezes are created and what to monitor.Assuming you have been following CEP stock, you may have been wondering why the short interest and merger updates, not to mention the volatility, are on the rise. To traders who are on the go, these are not mere figures but warning bells on what to expect next. Short interest will inform you of the percentage of the market that is betting against CEP and how fast the sentiment may turn against it in case of a buying spurt.

With the possibility of low float, redemption spikes and borrow costs all moving in a matter of days in a post-merger setting, it has become necessary to understand CEP stock short interest data. You can be watching a possible short squeeze or you just want to time your entry, this analysis dissects all that you need to know, not only in terms of the current short-interest trends and borrow market information but also in terms of the actual market signals that traders are using to push the market.

By the end of this article, you will understand how to decipher short-interest measures like an expert, when CEP may be susceptible to a squeeze, and how the same measures top traders monitor before significant price fluctuations.

Table of Contents

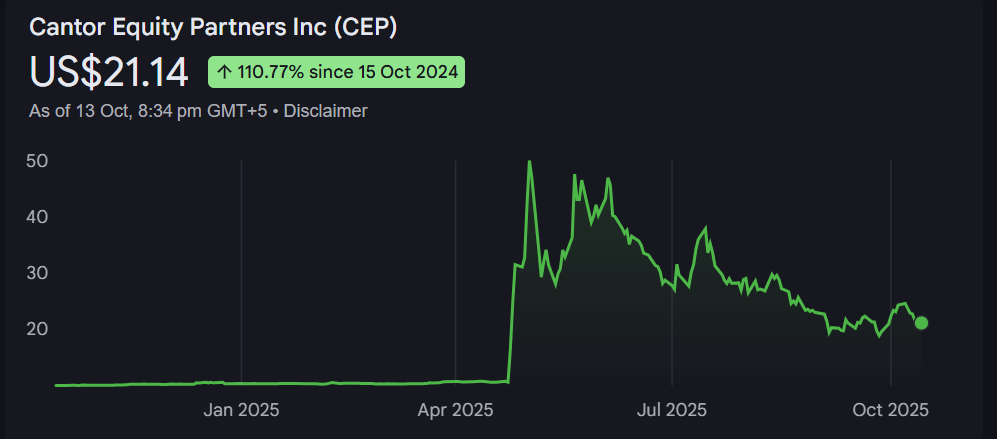

Quick snapshot: Why CEP short interest matters now

CEP stock has been in the limelight not only by virtue of the merger with Twenty One Capital but also because of the cep stock short interest patterns. Short interest is an important measure that traders are monitoring since with a volatile SPAC such as CEP, excessive short interest may be a precursor to squeeze risk or reversals. The merger puts in additional fuel: should short sellers make wrong timing or redemption judgments, they can be really squeezed. In this article, we disaggregate the data, trend, and read the signals in the market in a way that would make you understand that something is critical to the short interest.

Key short-interest metrics every trader needs

Short interest indicates the shares of CEP stock that have been sold short but without being covered or closed out. It is one of the essential indicators of traders who attempt to measure the mood in the market. Whenever short interest is increasing at an alarming rate, it is usually an indication that most investors are betting against the stock- anticipating that the stock will go down.

However, this can also set up the conditions for a short squeeze if the price unexpectedly moves higher and short sellers rush to buy back shares. For a thin-float company like CEP, even small increases in short positioning can lead to outsized price swings because fewer shares are available to trade. That’s why understanding short interest levels and their movement over time helps traders balance risk and timing when trading CEP stock.

Each of these metrics gives you a piece of the picture. For CEP, because float is relatively small and volatility is high, shifts in any one can disproportionately influence risk.

How to read “short percent of float” for a thin-float SPAC

Short float is already high at 10 20 percent on most stocks. In the case of CEP, however, a relatively small float SPAC, you can find spikes higher than 20, 30 or even 50 percent in some windows. A high short percent of float means many traders are betting against the stock, but in SPACs, this also means higher risk of short squeezes—because small supply can exacerbate covering pressure.

Days-to-cover: what level signals squeeze risk for CEP?

Days-to-cover is used to determine the number of trading days to re purchase all the shorted shares at the average volume rate. In the case of CEP, days-to-cover of more than 3-5 days is of interest.When it exceeds 7-10 days, that would be a possible squeeze indicator, particularly in conjunction with short percentage increases and decreases in float.

Here’s a sample table of current short interest metrics for CEP based on public sources:

| Metric | Value | Notes / Source |

| Short interest (shares) | ~ 1,630,059 | Source: Fintel short tracker |

| Short % of float | ~ 25.87 % | Source: Fintel / Capital IQ |

| Days to cover | ~ 7.22 days | Source: Fintel |

| Borrow fee | ~ 17–19 % APR | Source: Fintel “Short Borrow Fee Rates” component (Fintel) |

| Avg daily volume | ~ 340,000 | From short interest trackers / public sources (shortinteresttracker.com) |

Note: These values are approximate and change bi-monthly with FINRA reporting cycles.

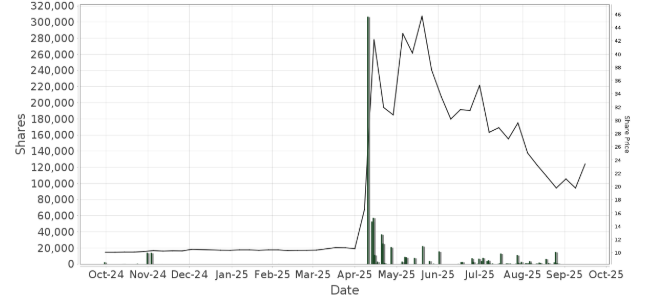

Historical short interest trends for CEP: patterns & triggers

Knowing the trend on the long-run will make you appreciate how short interest reacts to events and sentiment changes.

For CEP, short interest was modest in early periods, then climbed sharply as merger speculation intensified. Spikes often align with merger announcements, SEC filing windows, and press releases. Traders tend to increase short exposure when the deal seems stretched or when redemption fears emerge.

When superimposed with the key dates such as S-4 filing dates, proxy announcement, or public commentary, these trend charts can indicate where there is a tendency to increase short positioning.

Short interest vs merger milestones: event study approach

This part seals a major gap: short interest response around.

| Merger milestone | Effect on acquiring company’s short interest | Effect on target company’s short interest |

| Pre-announcement | Often stable, with potential for increases if there is market speculation of overvaluation or pending acquisition. | High short interest may indicate that the market views the stock as undervalued, which can precede an acquisition. |

| Announcement | Increases, particularly in stock-for-stock deals. Arbitrageurs short the acquirer’s stock to profit from the spread between the offer price and the target’s stock price. | Increases due to merger arbitrage, as the stock price typically jumps but remains below the announced acquisition price. If arbitrageurs expect the deal to fail, they may short the target stock. |

| Due diligence and regulatory approval | Fluctuates based on market perception of deal success. Delays or negative news can increase short interest as deal risk rises. | Volatile. The level of short interest is a measure of market confidence in the deal. Negative news from regulators or other due diligence findings can increase short selling. |

| Merger completion | Short interest shifts. Arbitrageurs cover their short positions, and the acquiring company’s short interest now reflects market sentiment on the newly combined entity. | Short interest disappears. The target company’s shares are exchanged for cash or the acquirer’s stock, and all outstanding short positions are automatically closed out or converted. |

| Post-merger integration | Determined by the market’s reception of the newly merged company’s strategic direction, financials, and integration progress. Challenges can lead to a sustained increase in short interest. | The target company no longer exists as a separate entity. |

Typical short behavior around S-4 filing and shareholder vote

In the past, short-sellers are known to front-run major events. Indicatively, during the pre-S-4 filing days, higher short builds can be witnessed in case the market expects a risk of dilution or redemption. After filing, some may cover if uncertainty resolves. Similarly, ahead of shareholder vote, short builds or reductions can happen depending on sentiment momentum.

By seeing how short interest behaves relative to those milestones, you gain insight into typical short timing and how traders position themselves.

Redemption math and short risk: Why redemptions change the squeeze picture

Short interest ratios are connected with float. When high levels of redeeming are done by holders, the float decreases, and short percent and days-to-cover increase although absolute short interest remains the same. That means redemptions can magnify squeeze risk.

Simple redemption scenarios and their short-interest impact

Suppose the following hypothetical scenarios with the help of trust fund size and outstanding share information of S-4 of CEP:

- 10 % redemption scenario: float shrinks; short % rises modestly

- 30 % redemption scenario: float shrinks further; short % jumps markedly

- 60 % redemption scenario: float tightens drastically; extreme short % and days-to-cover

| Redemption Rate | New Float | Implied Short % | Days-to-Cover Estimate |

| 10 % | 90% of original | ~ 28 % | ~ 8 days |

| 30 % | 70% of original | ~ 37 % | ~ 10 days |

| 60 % | 40% of original | ~ 65 % | ~ 15+ days |

These models demonstrate the extent to which the short position becomes precarious when a large number of shares is exiting the pool.

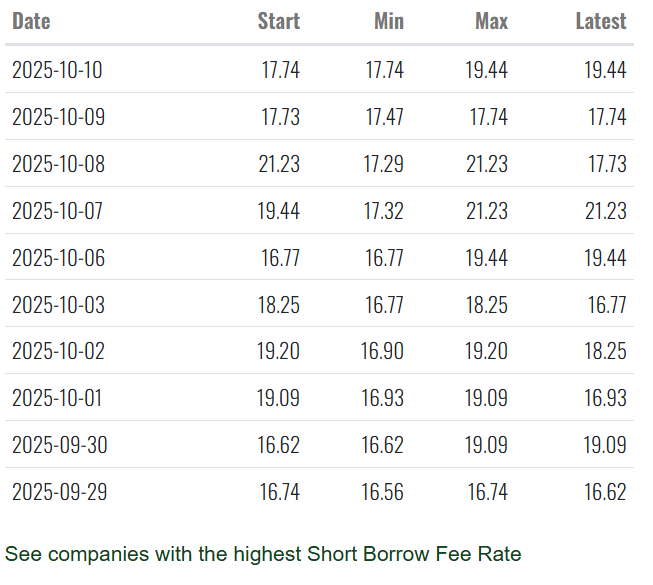

Borrow market & cost-to-borrow: real constraints on shorting CEP

Although the short interest may appear high, shorting is actually restricted by borrow availability and borrow fee rate.

When the cost of borrowing is high, e.g. 17-20 APR, a lot of short sellers will not develop new investments. When locates are difficult to get, then it becomes more risky to short. This is a self-imposed throttle of short positioning.

Where to check borrow data and live cost (practical tools)

Some sources you can monitor:

- S3 Partners borrow cost & availability analytics

- IBorrowDesk / Interactive Brokers locate tool & borrow rates

- Ortex combined short interest + borrow cost data

- Fintel shows short borrow fee rates for CEP

A rising borrow fee often precedes short squeeze pressure, because short sellers face margin drag, making covering more urgent.

Options with open interest: the hidden short squeeze fuel

Short interest is not the only side of the story. Big open interest options, particularly in calls, can push hedging flows by market makers that can squeeze shorts by pushing the stock up.

With CEP stock, abnormal options volume, variations in put/call ratio, and concentrated open interest in short-run contracts are cues that can put you in the position of early squeeze.

Quick method to read options signals for CEP (build your signal set)

Watch for:

- Big jumps in call-side open interest on elevated volumes

- Shrinking put/call ratio

- Overwhelming open interest in near-expiry strikes near current price

- Option implied volatility spikes

If option hedging activity aligns with high short % and shrinking float a squeeze setup strengthens.

Microstructure & liquidity: thin-volume traps that mislead TA

CEP will not be able to have high volume especially on off-news days. That puts microstructure problems and some large trades can corrupt the price and send misleading moving averages breaks.

In such regimes, short squeezes can blow out unexpectedly because illiquid markets offer little resistance to large orders.

Institutional vs retail shorting: who is betting on CEP?

One should be aware of the short sellers of CEP. Shorting can be more strategic and more profound when it is common with institutional or hedge funds. If retail shorting dominates, positions might be more fickle and vulnerable to sentiment reversals.

Where to find clues (13F, block trades, margin reports)

- 13F filings show institutional holdings

- Block trade records or SEC Form 4 can show large short sales

- Brokerage data or margin use sometimes indicate growing retail short exposure

Even though such cues are not precise, they help to build an image of the individual making the bet and its intensity at the moment of the stress.

Scenario stress tests: modeled short-cover storms

In order to make this possible, consider the example of 25 percent or 50 percent of the outstanding shorts covered in the short term. Combine days-to-cover with average volume to simulate price moves.

For example:

- Scenario A (25 % cover): Upward price impulse, short squeeze, moderate rally

- Scenario B (50 % cover): Steep short squeeze, significant upside beyond expectations

These stress tests make you view what can occur not what will occur.

Combining short interest with fundamentals & merger news

Short interest will not be sufficient.The strongest signals come when short metrics align with fundamentals and merger developments.

As an example, when short interest is high, and S-4 dilutes or has poor dividend policies, that strengthens bearish positioning. If short interest rises while merger certainty increases, that may tilt toward a squeeze scenario.

Thus, always view short interest, redemption math with deal disclosures together.

What traders should monitor live (actionable checklist)

If traders want to succeed then this is a live checklist that you must remember:

- Short interest publication dates (FINRA schedule)

- Borrow fee spikes or availability changes

- Option volume / OI anomalies

- Redemptions reporting (actual vs expected)

- Merger filings (S-4, proxy, 8-K)

- Volume and volatility spikes

- Block trades or insider / sponsor activity

All these happenings have the potential to change the short-interest situation in a short time.

Conclusion: how to use CEP short-interest signals without getting burned

A live sentiment indicator to the SPAC market traders is the short- interest behaviour of CEP stock. Short positions will generally be a sign of either the unconfidence in the deal being closed or valued, but sudden drops may reflect shorting out of position before bullishness occurs. The key moral to this is that short data should not be viewed independently of fundamentals, borrow costs and redemption outcomes.

Such indicators coupled with systematic risk management, restrictive stop policies, and frequent scrutiny of filings and borrow costs would enable investors to predict market turns better. Lastly, the capabilities to identify a squeeze and a CEP short interest are not the only ones but the capabilities to understand how the integration of the sentiment, liquidity, and the time of the events relates to the next move.

Short interest can auger strong action when it starts to spike on a thin float SPAC such as CEP. However, the moves are only made when several conditions are in place, that is, use the signal, but do not put all your money on it. Be careful about the news, the graphs and developments of mergers, and you will have a better-prepared and better-informed approach, as the saga of CEP continues

Short-interest FAQs (quick answers for traders)

Q1. What is CEP’s current short interest and does it indicate a squeeze risk?

As of recent public sources, CEP has about 1.63 million shares short, which translates to 25.87 % of float and a days-to-cover of about 7.22 days. This level of short interest in a thin float setup is a red flag for potential squeeze scenarios.

Q2. How often is CEP stock short interest data updated?

Short interest is officially updated twice each month under FINRA rules covering positions settled at the 15th and end-of-month dates. Between those updates, borrow cost and short availability data provide useful intraday signals.

Q3. Can redemption levels suddenly make short interest misleading?

Absolutely! When large redemptions happen, they reduce the float, which in turn inflates the short percentage and days-to-cover, all without altering the size of the short position. This dynamic can either amplify signals or lead to misunderstandings if you overlook the math behind redemptions.

Q4. When does a high borrowing fee matter more than short interest?

If borrowing costs shoot up let’s say above 15-20%. While short interest is already elevated, a lot of short sellers might find themselves squeezed out due to the cost of carrying those positions. So, rising borrow fees can actually serve as a warning sign for a potential short covering cascade.

Q5. Should traders rely solely on short interest to time entry/exit?

On the flip side, short interest is just one piece of the puzzle. You need to look at it alongside option activity, merger news, redemption data, and the overall liquidity context. Think of it as a signal rather than a complete strategy.

Q6. Does CEP’s merger status magnify short interest signals?

Definitely! The merger introduces structural catalysts like dilution, redemptions, and event deadlines that make the behavior of short interest much more reactive compared to regular stocks. When you have high short interest combined with merger risk, it significantly ramps up volatility.

Q7. Is CEP stock being targeted for a short squeeze on social media platforms?

There’s been a lot of chatter on retail forums about the potential for a CEP short squeeze, but traders should stick to verified data from NASDAQ and FINRA for their insights.