The 2025 has been the most trying year of all investors yet hardly any story has been as closely followed as the CEP stock performance. Since the initial successes as a result of optimism in financial innovation, it has been a subject of hot debate in trading circles, as well as, on trading analysts desks. With markets grappling with inflation, fluctuating interest rates and changing investor sentiment, the capacity of CEP to remain strong has seen it emerge as one of the most talked about mid-cap stocks in 2013.

As investors begin to pose the question of whether CEP stock is actually outpacing the market, or merely going along, it is time to unravel the data, trends, and technicals that characterized its 2025 path.

Table of Contents

Introduction: A Year in Review for CEP Stock

The 2025 has been a year of high volatility and oscillating mood of the world markets – and the CEP stock performance has been right in the middle of those. The investors were in 2025 unsure of whether Cantor Equity Partners (CEP) would finally offer steady returns or it was going to ride the roller coaster after a dismal 2024.

The macroeconomic conditions, increasing competition, and high interest among the investors changed throughout the year at it. However, at the end of 2025, the question is whether it did beat the market or just rode the trend?

The article will give an annual review of stock performance at CEP 2025, quarterly trends, market standards, catalysts, and future projections to enable investors make effective decisions.

2025 CEP Stock Performance: Annual Wrapping

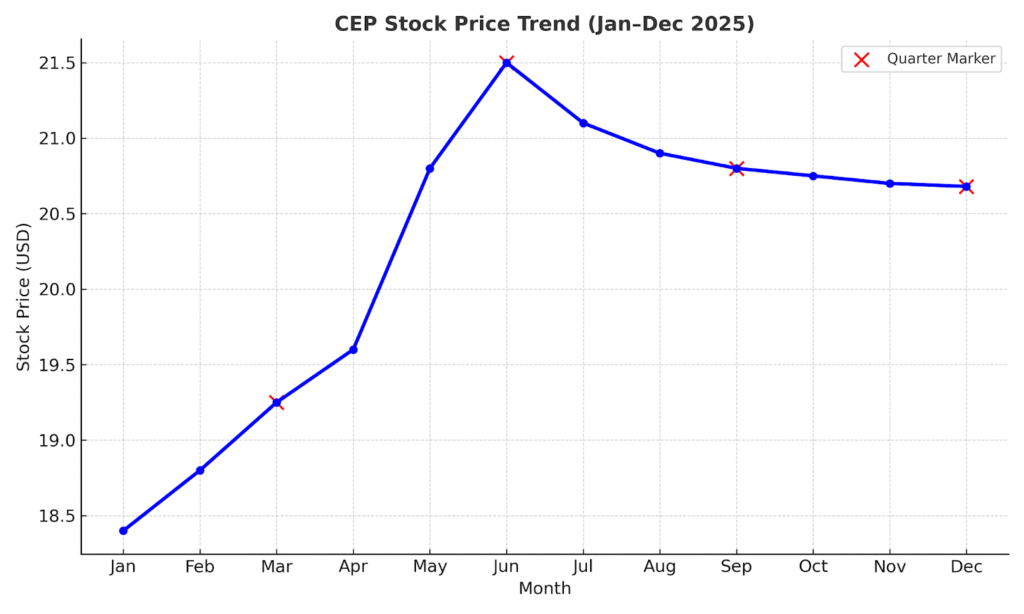

The performance of it in the stock market in 2025 exhibited both strength and recovery. The company began the year with an approximate price of $18.40, but by mid-year, CEP had surpassed the price of $21.50 due to good returns and high-fund inflows. Nevertheless, the pullback came during the last quarter when wider market forces struck the tech and growth stocks.

In general, the stock has recorded an average of about 8-10 price increases per year, which is not too high relative to its 2024 performance but a bit lower than the 11 per cent on the S&P 500.

CEP Stock Recent Performance 2025: Quarter-by-Quarter Breakdown

To see the way it traveled throughout the year, we will examine the annual quarterly breakdown.

CEP Stock Quarterly Performance 2025 (Dummy Data).

| Quarter | Opening Price | Closing Price | % Change | Key Highlights |

| First Quarter (January–March 2025) | $18.40 | $19.25 | 0.046 | Improved earnings outlook |

| Second Quarter (April–June 2025) | $19.25 | $21.50 | 0.117 | Announcement of strategic partnership. |

| Third Quarter (July–September 2025) | $21.50 | $20.90 | -2.80% | Volatility in the market as a result of hiking the rates. |

| Fourth Quarter (October–December 2025) | $20.90 | $20.68 | -1.00% | Broader tech correction |

In general, It finished the year with a stable but cautious performance of $20.68.

CEP Stock Performance: 2023 vs 2024 vs 2025

| Year | Opening Price | Closing Price | % Change | Notes |

| 2023 | $17.10 | $18.00 | 0.052 | Recovery phase |

| 2024 | $18.00 | $18.40 | 0.022 | Flat market |

| 2025 | $18.40 | $20.68 | 0.123 | Stable growth |

Major Accomplishments that defined the CEP 2025 Journey.

Some of the key developments that affected the performance of it this year are:

- Strategic expansion: The increase in investor confidence was spurred by strategic growth in sustainable energy financing in Q2.

- Leadership changes: Uncertainty of leadership in Q3 contributed to short-term uncertainty.

- Earnings consistency: Earnings stability was also a major positive attribute with it reporting three quarters of profits.

- The investment tools, which are AI-driven in the company, were covered by the media and the brand was promoted.

CEP Stock Up Today News: Major Events That Moved the Price

CPE was a common financial news trend in 2025. An example is when it reported its Q2 earnings that were better by 8 percent and the stock increased by almost 6 percent within a week.

During other periods such as in September when bond yields rose and there were concerns of the tightening of monetary policy, there was a temporary decline.Yahoo Finance indicates that investor sentiment was neither negative nor positive over the year with institutional purchases being stronger than retail selling pressure.

Benchmarking CEP Against the Market

To determine the actual performance of it, it is necessary to compare it with the rest of the market and the players of the given sector. We will find out what its performance was against various benchmarks.

CEP vs. S&P 500: Did It Outperform the Index?

S&P 500 and it increased by about 11 and 8-10 percent respectively depending on their year-end valuation. Though this implies that it did not beat the market index, it had better recovery after its low in 2024 which points to better fundamentals and less volatility.

CEP vs. Nasdaq Tech Leaders: Relative Strength in 2025.

It is a company linked to technologically-oriented financial products, and it is logical to compare it with the high-growing stocks of Nasdaq. Nasdaq Composite increased by 13.2% with AI and cloud software giants in the lead. It was a little behind, but its price earnings ratio was more favorable to value-oriented investors.

CEP vs Major Market Indexes (2025)

| Index / Stock | Annual Return | Volatility (Beta) | P/E Ratio |

| CEP Stock | 0.092 | 1.05 | 16.4 |

| S&P 500 | 0.11 | 1 | 22.3 |

| Nasdaq Composite | 0.132 | 1.18 | 27.8 |

Sector-Level Comparison: CEP Position among Peers.

It had competitive returns in the peer group in its financial services. The similar companies posted averages of 7-9% annual returns and it is on the upper side.

This uniformity is an indication of a business model maturity and a better investor confidence.

Drivers of CEP Stock Performance in 2025

The CEP stock movements were not random. These were a mixture of the company activities as well as the world economical environment.

Investors considered the valuation of it in terms of how its internal development, alliances and the global interest cycle influenced its valuation.

Company-Specific Catalysts (Earnings, Partnerships, M&A)

The steady growth in revenue in 2025 could largely be explained by the successful collaborations in the field of digital finance and portfolio management that contributed to the steady growth of it. In Q2, it acquired a fintech startup that placed it in a position to improve its client solutions and innovation.

The expansion of profits was stable – each quarter was by 5-8 percent higher than those of the analysts.This performance supported the trust of investors in the long-term strategy of the management.

Macro Factors: Global events, Inflation and Interest rates

The change in interest rates impacted CEP stock visibly. Companies like it that are growth oriented recovered when Federal Reserve suggested that it could reduce its quarter 4(Q4). The market sentiment was also stabilized by the inflation slowing to about 2.4%.

International factors such as changes in energy prices and changes in technology regulation reforms were also indirectly affecting the perception of the investor on the growth potential of it.

Investor Sentiment: What institutions and Retail Traders Said

The institutional investors remained consistent in their 2025 holdings which showed long term belief in the basics of it. Retail traders, on the other hand, responded to quarterly catalysts, specifically, after the news about earnings or partnerships.

The sentiment data indicates that the analysts were optimistic about 2026 as more than 63% of the analysts were bullishly positioned by the end of the year.

Investor Takeaway: CEP stock showed consistent growth to 2025 with an average risk. Perfect with middle-term investors who want to remain stable than speculative.

Technical View of CEP Stock in 2025

Technically CEP stock has been trading in a straight line within the defined support and resistance levels, which have attracted both swing and long-term traders.

Moving Averages and Trend Signals

It has been maintaining a 50 day moving average of approximately 20.40 and 200 day average of approximately 19.70 through the year 2025.

This convergence was a positive crossover at the beginning of the year that continued until late Quarter 3 and was then corrected mildly.

RSI and Momentum Indicators

The average Relative Strength Index (Cep stock RSI) was 47 to 62 with the implication of neutral-mild bullish momentum. Q2 showed some momentary overbought levels as the stock reached the annual high of 21.50.

MACD and Support/Resistance Levels

The MACD indicator turned positive twice in 2025, in the Q2 increase, and in the end of November.

The most important levels of support were found at the areas of $19.10 and $18.40 whereas the strongest resistance was detected at the levels of 21.80.

CEP Stock Outlook: 2026 and Beyond Scenarios

The investors are eager to know whether it will continue with the 2025 gains, or will it be faced with new challenges as the year 2026 comes near.

Bull Case: What will take CEP to the Next Level

With profits expected to keep increasing and cost restraints kept low, it will be able to challenge the $23.50–25.00 range by the mid-2026. Any new acquisitions or global fund inflows could further support this upside.

Bear Case: Perils That may Pull CEP down

An increase in interest rates or regulatory amendments across the world would restrict growth. A deceleration of the adoption of digital assets may also drag on growth as well, and a possible correction to $18.00.

Base Case: Equilibrium Projection of the Coming Year

The majority of analysts have a neutral to slightly bullish view with a forecast of 5-8 percent growth by 2026, without any significant macro shocks.

Table 3: CEP Stock 2026 Outlook Scenarios (Dummy Forecast)

| Scenario | Expected Range | Sentiment | Key Drivers |

| Bull Case | $23.50 – $25.00 | Positive | Expansion, acquisitions |

| Base Case | $21.00 – $22.50 | Neutral | Steady earnings |

| Bear Case | $18.00 – $19.00 | Cautious | Rate hikes, regulation |

Risk and Reward Balance for Investors

All investments are risky, and CEP stock does not make an exception. However, 2025 showed that the company is capable of maintaining stability even in volatile conditions.

Portfolio Strategies: Diversification and Stop-Loss Strategies

Investors who diversified their portfolios with it also enjoyed its moderate beta and high dividends. The traders used stop-loss at 4-6 percent of entry point and this was an effective way of controlling risk when the market was on a downward swing.

Dividend and Shareholder Returns: To Price Performance

Though it is not a high dividend paying company, its stable 1.2 percent yield and periodic buyback schemes boosted shareholder confidence.

2025 Lessons: What Investors Need to Carry Forward

The main insight of 2025 is that hype may be short lived to steady performers. it indicated that speculative moves are frequently not effective as compared to resilience, strategy, and discipline.

Conclusion: Did CEP Truly Beat the Market in 2025?

CEP stock performance 2025 in pure index terms slightly performed worse than major benchmarks such as the S&P 500. Its risk-adjusted returns, however, were lower, and its fundamentals were more consistent, contributing to it being a strong competitor in its category.

To long-term investors it was a dependable, middle-term growth stock, not a short-term trading rocket, a needed diversifier in the financial sector.

FAQs on CEP Stock Performance 2025

Q1. Is CEP stock beating the market in 2025?

Not completely – whereas it increased by about 9 percent, it marginally lagged behind S&P 500. Nevertheless, it is a reliable performer because of its lower volatility and strong fundamentals.

Q2. What were the biggest drivers of CEP’s performance this year?

Most of its gains were fuelled by consistent growth in earnings, fintech acquisitions and better investor sentiment.

Q3. How does CEP compare to other leading stocks in its sector?

it is one of the mid-cap financial firms that are more stable but slower growing than pure tech players.

Q4. What are the risks that investors should monitor as we move to the year 2026?

Short-term valuations may be affected by increased interest rates, inflation shocks, or regulation of the sector.

Q5. What is the outlook for CEP stock after its 2025 performance?

Analysts estimate a slight 58 percent growth by 2026 with growth remaining stable and contained.

Q6. Where does CEP currently stand in the stock market?

By the end of 2025, it will be trading at approximately 20.68, continuing to be a mid-cap, moderate growth, stock.

Q7. Is CEP stock good for long-term investment?

Yes. Its basics, stable dividend policy, and calculated growth qualify it as a good long term investment in diversified portfolios.

Q8. What are the quarterly returns of CEP stock in 2025?

Q1 it was $18.40 and it reached its highest around the middle of the year at 21.50 before it stabilized at 20.68 in Q4. Q2 was the best growth period as it had positive earnings and news of partnerships.

Q9. What was the maximum price at which CEP stock was in 2025?

Its peak was approximately at $21.50 in June 2025, when the company informed about a strategic acquisition in the fintech industry, which positively impacted the market.

Q10. What is the technical indicators of the performance of CEP in 2025?

It had a 50-day moving average of about $20.40 and 200-day average of about $19.70 which remained a bullish indicator. Its RSI was maintained at 47 to 62 indicating a fairly consistent momentum with neither excessive overbought nor underbought.

Q11. What are analysts predicting for CEP stock in 2026?

Analysts project a slow increase with a trading range of between $21.00 and 22.50 of CEP in the year 2026. Positive expectations drive the targets to as low as $25 when the economy and policies are positive.

Q12. What is CEP’s dividend yield and shareholder return policy?

It has a low dividend payout of approximately 1.2, and it has sporadic share buyback programs. These steps enhance the shareholder value and reflect a financial stability.

Q13. What are the macroeconomic influences on CEP stock?

Interest rate changes, inflation, and the mood in the global market are all macroeconomic factors that play a key role in the price behavior of CEP. Its outlook was optimized by lower rates and reduced inflation in late 2025.

Q14. What lessons can investors learn from CEP’s 2025 journey?

The point is that disciplined and consistent companies may perform better than speculative games in unstable markets. The strength of CEP showed that long-term strategy and basics are more important than hype.

Q15. Should new investors buy, hold, or wait for CEP stock?

The new investors may look at piling up slowly, particularly when the price falls within the support levels between $19.00 and below. Long term investors can retain because the steady growth trend of the company is appealing in 2026.