CEP stock has gained more and more attention among both retail and institutional investors. Traders are paying close attention to the out-of-hours performance of CEP as markets pay increased attention to its SPAC background, market volatility, and regular news catalysts. Knowledge of after-hours and premarket trading can aid investors to identify early momentum, respond to news and make more effective entries or exits prior to the start of the primary market session.

Table of Contents

Introduction — Why CEP Stock’s Extended-Hours Activity Deserves Attention

Cep stock attracts the interest during extended hours as large news tends to fall outside the normal trading. CEP has the ability to pounce on a merger note, crypto-partnership or spurts of social conversation.In this article, we are going to have a look at how to read those moves, risks, and how to trade smartly when the price action changes outside the bell.

Understanding CEP Stock After Hours & Premarket Sessions

It is during after-hours and premarket trading that most of the unseen market action is carried out in the run up and after the official bell. These periods let investors respond to late-breaking news, earnings updates, or market sentiment shifts before the regular crowd steps in. For CEP stock, watching these sessions can reveal early hints about investor confidence, short-term volatility, and how the next trading day might unfold.

What “After Hours” and “Premarket” Trading Mean in Simple Terms

After and premarket trading allow investors to make orders outside of the usual 9.30 to 4.00 p.m. ET trading day.Premarket runs before the bell, while after-hours runs after the bell. These sessions have lower volume, meaning fewer participants and sharper price jumps on the same news. For cep stock, that makes early clues useful but risky.

CEP’s Typical After-Hours and Premarket Time Windows (U.S. Market Hours Explained)

In the U.S., premarket often starts at 4:00 a.m. ET and runs until 9:30 a.m. ET. After-hours commonly runs from 4:00 p.m. ET to 8:00 p.m. ET. Every broker establishes its windows and rules of orders.

Why CEP’s Extended Hours Can Be Volatile Compared to Regular Sessions

Cep stock is usually low during long hours. Thin markets imply an increased bid-ask spread, and even a large order may cause the price to change considerably. Because price discovery is less efficient, even a brief Reddit thread or press release can create sharp swings in premarket or after-hours trading.

How CEP Stock Moves After Hours: Patterns, Liquidity, and Behavior

The after-hours price action in CEP stock is usually a story in itself. As common trading comes to an end, liquidity is thin and small orders may result in unexpected large price movements. Knowledge of CEP behaviour in these periods of low volume assists traders with early indications of how the market is going to perform the following session or whether it is a temporary response to breaking news.

Historical After-Hours Trends: When CEP Moves Most

CEP is prone to move the most when a company is updating its core (such as news about de-SPAC, partnerships, or crypto-related news). Late-day SEC filings or press releases often spark premarket reactions the following morning.

Average Volume, Bid-Ask Spread & Liquidity Insights

The average extended-hour volume of cep stock is usually 10 percent of that of the regular session. In the event of poor news, that ratio declines even more. Expect wider spreads and limited available size at displayed quotes, which increases the risk of partial fills or slippage.

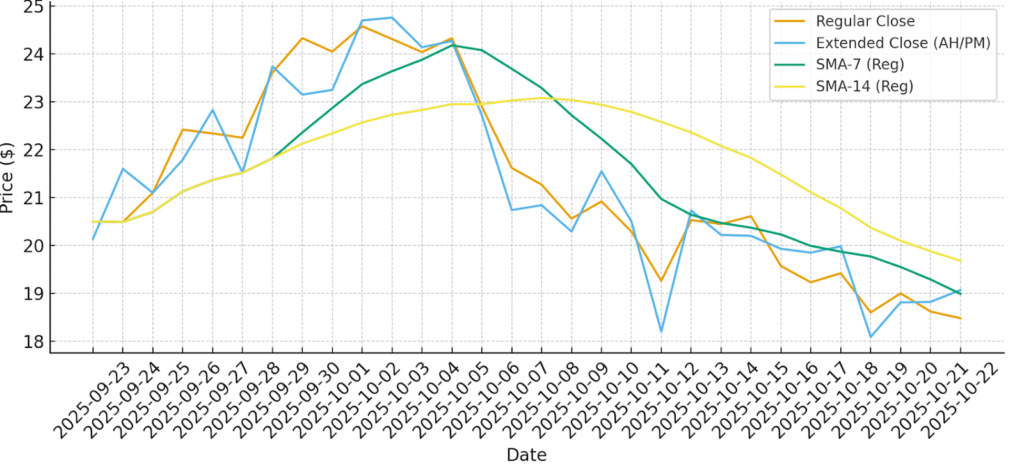

Comparing Regular vs Extended-Hours Performance

The extended-hours prices tend to initiate or enhance the movements that occur during the regular session. With cep stock, look at the prices of extended hours breaking important support or resistance levels, these may indicate a change of sentiment ahead of the open.

CEP Stock Premarket Price Insights & Early Market Signals

Premarket trading is early morning coffee in the market that gives you the idea of how the investors are feeling even before the day has started. In the case of CEP stock, the first few hours can tell a lot. When the price is rising steadily and the volume is increasing, then it is likely to indicate optimism or new news at night. But if it’s dipping while the broader market looks calm, that might hint at hidden concerns or large holders quietly adjusting their positions. Reading these early moves helps traders gauge whether the day ahead could bring volatility or stability.

How to Track CEP Stock Premarket Price and Volume

Real-time data from Nasdaq’s CEP quote page provides verified exchange-level information.

What Premarket Trends Reveal About Investor Sentiment

Stones on the feet are typically a good news or confident investors.The heavy selling implies reduction of exposure by large holders. Repeated premarket moves over several days imply a sustained sentiment shift.

Notable Historical Premarket Surges — Case Example

When an announcement of the type associated with CEP was announced towards the end of the day, the next day the premarket had experienced a sharp spike never before.

Interpreting Early-Morning Data Before the Bell

Large opening gaps are expected when CEP records a large amount of premarket volume and the trend has been established and 15 to 30 minutes have passed after the open to ensure direction once the liquidity returns.Limit orders and wait an additional 15 to 30 minutes after the open.

Where and How to Trade CEP in Extended Hours

Trading CEP during long hours is not only about the time of doing it, but also the instruments and platforms.Not all brokers handle after-hours trading the same way, so knowing where and how to place your orders can make a big difference. Whether you’re a casual investor checking CEP’s premarket momentum or an active trader responding to late-breaking news, understanding your broker’s rules and execution windows helps you act faster and smarter without unnecessary risk.

Which Brokerages Allow After-Hours & Premarket CEP Orders

The extended hours are not supported in trading in all brokers, though Robinhood, Fidelity, and Interactive Brokers support it, with different policies. Confirm order type availability and time windows before placing CEP trades.

Step-by-Step: Placing Limit Orders for CEP After Hours

Limit orders must be employed in all the extended sessions with cep stock. Confirm your order will execute in extended hours and avoid market orders due to volatility.

Order Types That Work (and Those That Don’t)

Limit orders tend to fill unpredictably and in long hours market orders. Always verify with your broker.

Practical Risks: Partial Fills, Wide Spreads & Thin Depth

Small available sizes tend to fill the after-hours trades half-way up. Large orders may execute at multiple price levels, increasing slippage. Split orders or use smaller sizes to manage risk.

The Hidden Risks & Rewards of Trading CEP Stock After Hours

After-hours trading in CEP stock may be a delightful prospect – to be able to swarm early before the crowd – but at what cost? Prices swing faster, liquidity thins out, and spreads widen. Still, for traders who understand the rhythm of extended sessions, these quiet hours can reveal early clues about market direction long before the next day’s open. The key is balancing curiosity with caution knowing when to act and when to simply observe.

Liquidity, Price Discovery, and Volatility Explained

The longer hours are less liquid and the discovery of price is inaccurate. That can present an opportunity for informed traders but adds risk of fast reversals when the regular market opens.

How News Timing and Earnings Affect Extended Trading

After-hours moves are typically brought about by after-hours announced news. Reactions can be sharp but fade quickly. Traders who wait for premarket confirmation often get better entries.

Managing Position Size and Limits for Thin Markets

Sell smaller sizes during long hours. The stop limits are to be applied intelligently, the majority of the brokers do not set the stop limits after the hours.

Why After-Hours Price Differs From Closing Price

The after-hours prices reflect the new information and poor liquidity and the closing price is the standard trading price.

Tools & Platforms to Monitor CEP’s Extended Performance

The majority of traders fail to understand the power of the right tools in terms of monitoring after-hours and premarket activities of CEP. Trustworthy platforms do not merely present the prices, but demonstrate trends, change in sentiments and liquidity indicators that cannot be easily seen in casual charts. By using a mix of exchange-verified data sources and community-driven alerts, you can stay one step ahead of sudden overnight spikes or dips that catch most retail investors off guard.

Real-Time Data Sources for CEP Stock

The most reliable data on cep stock is found in Nasdaq. Sites like Investing.com and Public.com offer easy viewing but may delay data slightly.

Using Level 2 Data & Depth Charts

Level 2 shows order-book depth. Thin depth means that during long hours, few orders may lead to drastic change in prices. Watching large resting orders helps predict whether a premarket move will hold.

Recommended Apps & Alerts

Create early warning systems in price changes, abnormal volume and SEC filings.Combine mobile and desktop alerts to catch sudden changes. Social listening tools for Reddit or Twitter can flag early sentiment shifts.

How Corporate Events Shape CEP’s Extended-Hours Reactions

The CEP stock can be inverted by corporate announcements. Investors are also very responsive whenever an announcement is made in the form of a press release following a closing bell, e.g., a merger announcement, earnings announcement, or a SEC filing.These early reactions can set the mood for the next day’s trading. Understanding how CEP responds to such news helps you spot whether a premarket surge is just excitement or the start of a lasting trend.

Mergers, Announcements, and Filings That Move CEP

These initial actions are most often initiated by corporate filings and milestones during mergers. A de-SPAC update or partnership announcement may lead to strong premarket buying or selling pressure.

Case Example: Past CEP News & Premarket Volume

The premarket volume at CEP tripled the next day after the partnership announcement. Cunning merchants left early when prices were stabilized by the opening gap.

Lessons from Historical After-Hours Reactions

Extensive-hours migrations are the expression, not always of course, of feeling.

Tax & Settlement Insights for After-Hours CEP Trades

Trading CEP stock after hours, you can easily concentrate on price movements and forget that what follows is settlement and taxes. But those late-night or early-morning trades are the same as the daytime behind-the-scenes rules.

Understanding T+2 Settlement Rules

The execution date remains the trade date. Record transactions promptly for accurate reporting.

Tax Timing & Cost Basis for Premarket Trades

Maintain records carefully – unrecorded premarket trades will mess up the portfolio statements

Recording After-Hours Transactions

The majority of brokers provide extended-hours trades on the same daily statement but report them differently.

Expert Tips to Safely Trade CEP Stock After Hours

The most experienced traders are cautious even during long hours and with a reason. Prices are able to change rapidly, spreads can expand and liquidity can disappear within seconds. It does not imply that you should not do it at all, it simply implies that you have to be prepared in advance.

Setting Smart Limit Orders

Always put limit orders that have realistic pricing buffers. Never use market orders in thin extended sessions.

Using Technical Indicators with After-Hours Data

Base analysis based on regular-session levels. Use moving averages or support/resistance zones to filter noise and identify meaningful extended-hours breakouts.

Checklist: 7 Rules for Safer CEP After-Hours Trades

- Trade small sizes.

- Use limit orders.

- Monitor premarket volume.

- Check Level 2 depth.

- Confirm news from reliable sources.

- Prepare for partial fills.

- Log all trades for settlement and tax tracking.

Conclusion: Smart Trading Beyond the Bell

Cep stock premarket and after-hours are associated with risk but provide early information. They enable traders to determine sentiment, determine early trends and manage entries in a more strategic manner. Always buy and sell on a limited, small size and confirmed orders. View signals after-hours as previews and not predictions – and keep informed using verified information through trusted sources such as Nasdaq.

FAQs — CEP Stock After Hours & Premarket Explained

What time does CEP stock start trading premarket and after hours?

Premarket begins as early as 4:00 a.m. ET and continues to 9:30 a.m. ET. The average after-hours is 4:00 pm to 8:00 pm EST.

Why does CEP’s after-hours price change sharply?

Given low volume is magnifying price movements. Volatility can be caused by a single large trade or new information particularly when there is active social chatter.

Can I trade CEP stock premarket with every broker?

No. Broker support differs.Look at the policy of your platform regarding cep stock before you make extended-hours trades.

How can I check CEP’s premarket volume and live quote?

Use real-time sources of data such as the official Nasdaq quote page, to obtain official premarket volume and price information.

Are extended-hours CEP trades riskier?

Yes.Trading in the long hours is less liquid and spreads increased, which amplifies execution and slippage risk.

Do after-hours prices affect the next day’s opening?

They often do. Powerful long hours movements may result in gaps, but the volume of regular sessions can verify the success of the move.

How does social chatter affect CEP stock?

Speculative moves can be triggered by social platforms such as Reddit or Twitter. Monitor with a confirmation of the trading volume.

How should beginners track CEP on mobile apps?

The beginners can track their CEP stocks with Nasdaq against.

How can I limit losses trading after hours?

Trade with small positions, use limit orders and then wait till the regular-session confirmation before investing large capital.