The most asked question right now in the market: Is Cep a good stock to buy? Cantor Equity Partners, Inc. Class A Ordinary Shares, also referred to as CEP stock, has lately attracted a lot of interest in both retail and institutional investors. As twenty one capital continues to merge and become increasingly interconnected with the digital assets industry, it has emerged as one of the most highly monitored SPAC-sponsored equities in 2025. In this investment guide, the author discusses the question of whether to buy or sell CEP stock, dissection of its market performance, technical indicators, mechanics of this merger and investor perspective to enable the reader to make wise portfolio choices.

Table of Contents

Understanding the Core Question — What Makes Investors Ask “Is CEP Stock a Buy or Sell?

The questions that the investors tend to ask themselves are questions such as “Is CEP stock a buy or sell?” when the identity of a company changes- and this is certainly the case of CEP. In 2025, the firm is no longer just a blank-check vehicle but is transforming via a merger into a crypto-adjacent enterprise. That shift brings new variables: operational execution, merger risk, regulatory exposure, and macro/crypto cycles. The “buy or sell” question is no longer about momentum but about whether the new CEP will justify its valuation. In this article, we examine price, technical signals, fundamentals, merger mechanics, peers, risk scenarios, and more so you can decide if CEP stock fits your portfolio.

The surge in investor interest around Cantor Equity Partners in 2025

At the beginning of 2025, CEP started attracting retail investors and crypto-oriented funds. Most of the speculation is hypothetical: in case the merger is successful, it will provide leveraged crypto upside. Volume in it shot up on merger announcements. Many investors also see it as a bridge into crypto exposure with lower friction than direct token investing. That buzz has pushed the stock into the conversation among high-risk, high-reward speculative plays.

How CEP’s merger with Twenty One Capital transformed market guess

Previously, CEP used to be treated as a floating SPAC shell nearing its existence. However, the announced merger with Twenty One Capital re-invents its business model: to a blank-check to a crypto-enabled service platform (custody, trading infrastructure, etc.). There has been a change in market guess – now valuation has to be based on operating prospects rather than redemption math.Investors evaluate not just whether the SPAC can survive, but whether the merged entity can generate value tied to the crypto economy.

Stock Price & Forecast — What the Numbers Reveal

To base the discussion, we will be considering price, forecast context, volatility, and comparisons.

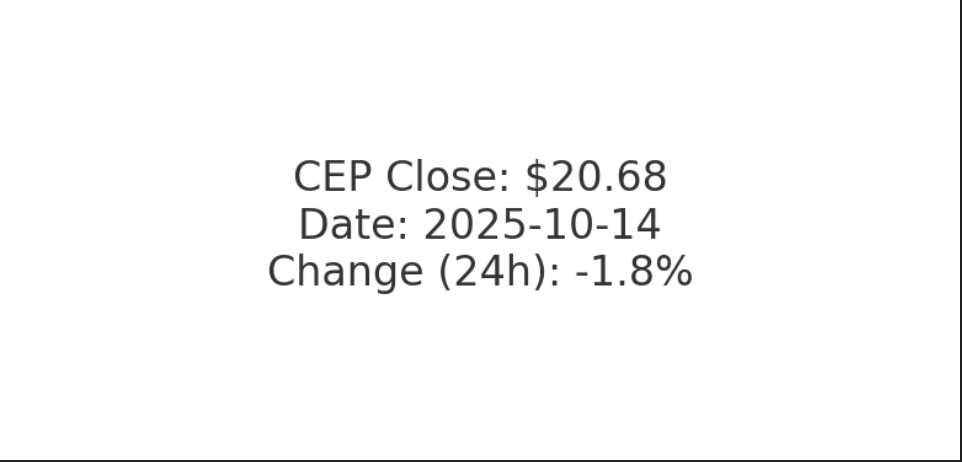

CEP stock price ended at $20.68 on Monday, after losing momentum

At the close of the most recent trading period, the stock was trading at 20.68 and is experiencing the pressure of profit taking or uncertainty of a merger.That final cost matters since it is the benchmark by which traders and long-term traders base their logic: can the stock get above the levels of over $22+ or will it fall below the levels of under 18+? The heading of this base is important.

Short-term volatility and daily trading behavior explained

The daily price charts of it indicate that it moves 5-10 percent on high-news days. Large gaps often occur after merger-related filings or macro crypto news. The intraday swings suggest the market is digesting information reflexively. For traders, that means you’ll need strict stop-losses. For long-horizon holders, it suggests patience will be necessary during noise periods.

Comparing CEP’s price stability with other SPAC-backed assets

| Ticker | Price | 1Y Return | Beta | Exposure Type |

| CEP | $20.68 | #ERROR! | 1.8 | Crypto / SPAC |

| PEER1 | $12.34 | –5% | 2.1 | Crypto custodian SPAC |

| PEER2 | $8.90 | 0.1 | 1.6 | Blockchain services SPAC |

Compared to peers, CEP’s beta is high, and returns are more volatile. That suggests it is more aggressively tied to market risk and sentiment. If peers with more stable business models trade more slowly, CEP’s premium is justified only if execution is strong.

Technical Signals – Market What the Market Indicators are Telling You

Technical analysis provides short and medium signal indicators.

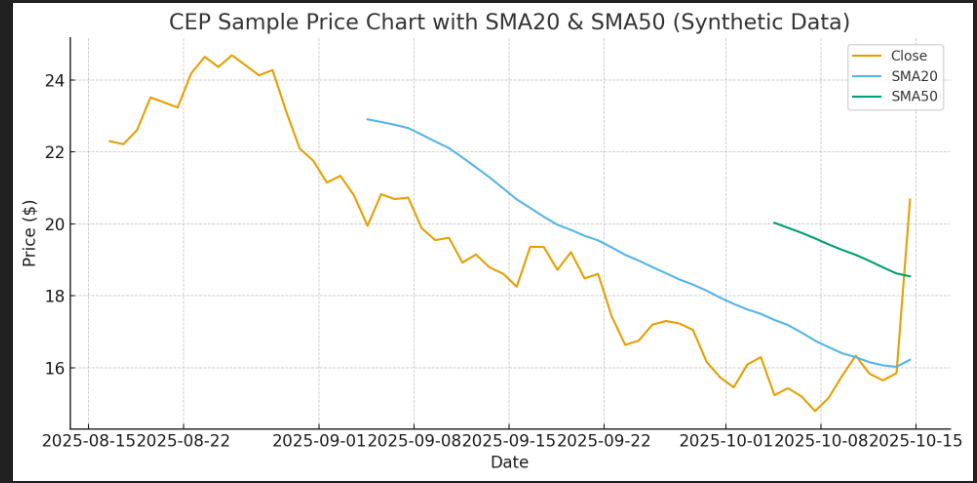

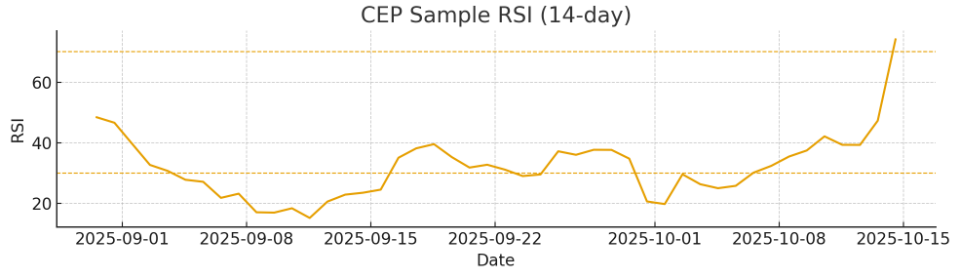

Most important momentum indicators: RSI, moving averages, and volume trends

The short-term weakness of our sample chart has been the decreasing SMA of 20 days as compared to SMA of 50 days. RSI (14-day) was recently on the increase of oversold (>30) to neutral (~50) with an indication of a possible bounce. Momentum however is weak unless it is supported by volume.

Floor and ceiling values of short-term trend

Support: -18 -19 area, where previous consolidations have taken place.

Resistance: At the range of about 22.50 to 24 sellers have been driven back historically.

It can retest mid-20s in case it clears above $22.50 on volume. Downside acceleration can occur in case it falls below 18.

Liquidity indicators on the market and institutional purchasing patterns

Where the institutions make large inflows (as it is observed in 13F filings or block trades) the stabilization of prices can be observed, and the demand support is created. Conversely, rise in short interest, insider selling or fall in institutional holding are risky.

Market Movers — The Analysis of the Cause of the Recent CEP Fluctuations

It is driven by a number of external and internal forces in its daily movements.

The relationship between Bitcoin and the performance

Given the fact that the future of CEP is pegged on the value of digital assets, the volatility of the price of Bitcoin is likely to spill over. In the case of a Bitcoin boom, investor confidence will provide stock with an impetus. During down trend, this stock is usually sold violently even when operational measurements are stable.

The responses of investors to merger announcement and deadline

Delays or unfavorable decisions can be harshly countermeasured. Clearances, vote approvals are positive milestones that can result in rallies as uncertainty fades.

Broader market sentiment and crypto-linked stock behavior

Speculative positions are sold off first at high macro risk like rising interest rates, inflation, geopolitical stress, etc. Cryptocurrency-linked securities are usually the most affected in the risk-off markets. In comparison, more inflows are received in the speculative plays such as CEP when the risk appetite increases.

Is CEP Stock a Good Buy Right Now? A 360° Look at Fundamentals

And now we pass out of technicals into the business reality.

Assessing intrinsic value and business foundation

Cantor Equity Partners should not only be a good buy, but its merged unit should provide more than speculative upside. It should generate revenue via custody fees, trading infrastructure, stable client acquisition, or recurring crypto service models. If the business plan leans heavily on token appreciation rather than real revenue, the investment thesis is weaker.

Leadership incentives, post-merger structure, and governance insights

Determine who is an equity holder, that is, who has performance-based earnouts, and how those incentives are in the interests of the shareholders. Poor alignment or large founder control can undermine minority holders. Robust governance (independent board, transparent reporting) is critical for credibility.

Comparison with peer SPAC-to-crypto mergers in 2025

In transactions that the merging company produced running results (and not merely token profits) investors were compensated. In those that relied mostly on crypto price, many were disappointed. Cantor Equity Partners, Inc. must lean toward sustainable operations, lower reliance on hype. This peer contrast helps frame expectations realistically.

Should I Buy CEP Stock in 2025? Balancing Risk and Return

The section can assist you in putting Cantor Equity Partners, Inc. in your own risk framework.

Long-term investor outlook after the merger integration

Cantor Equity Partners, Inc. could provide potentially high returns in case, in your opinion, the merged company will be able to establish sustainable revenues due to crypto services. But that belief must carry you through volatility, regulatory risk, and execution uncertainty. It’s not for the faint of heart.

The crypto exposure benefit opportunity or overhyped?

Crypto exposure has the potential to increase upside in case adoption runs. However, when the business relies too heavily on the price movement (as opposed to their revenue based on the service), you are basically gambling on Bitcoin. Distinguish between exposure that’s additive vs. foundational.

Evaluating potential downside risks in the current market climate

The regulatory crackdowns on crypto, integration failure, dilution through conversion and weakness of Bitcoin are downside risks. Any one of those can undo gains. Position size and risk controls are essential.

How the Merger Mechanics Shape CEP’s Investment Outlook

Here we explore the deal structure and the ramifications.

Knowledge on share conversion ratios and dilution factors

Merger conversion ratio tells us of how many new shares the existing Cantor Equity Partners, Inc. holders obtain. When the ratio is excessive to new investors or gives a big float, it dilutes the value. Follow-up issues of shares after close are also to be observed.

Merger liquidity restrictions and lock-up

Lock-up is usually applied to early stakeholders and insiders. They can only sell after expiration. This is an indication of a possible supply wave. Monitoring those timelines aids in estimating the areas of pressure.

Events and milestones to be followed in 2025 by investors

The most significant are: shareholder vote, SEC approval, redemption windows, listing date, first earnings report. Both of them are triggers that can either drive the stock down or up depending on how the market perceives them.

CEP Forecast 2025 – Analysts Expectations and Investor Scenarios

We now look into the possibilities of the future.

Outlooks of Cantor Equity Partners, Inc. performance in 2025-2026.

Analyst coverage is sparse. Some of the price targets that come include models that relate the crypto trends and user growth to the service revenue. Single point forecasts are replaced by use ranges (e.g. $1535).

Scenario analysis -> bull, base and bear market scenarios

Bull case: The adoption of crypto is booming, the management is performing, and the recurring revenue increases, so the CEP buys and sells several expansion.

Base case: Moderate growth, crypto stability, limited dilution will result in returns that are consistent yet low.

Bear case: Coding error, regulatory backlash, crypto crash → extreme downside.

What might cause a re-rating or sell-off of Cantor Equity Partners, Inc.

Positive catalysts: Large client acquisition, revenue surpassal, crypto boom.

Negative catalysts: Regulatory penalties, failure to meet expectations, high insider trading, negative court decisions.

Macro and Regulatory Factors on CEP Investment Case

No risky crypto game that will withstand regulatory and macro pressure.

Regulatory trends of SPAC and crypto-linked companies in the U.S.

Cryptocurrency is gaining close attention of regulators as either securities or commodities. The SPAC regulations became stricter following abuses. Any negative direction or enforcement measures may have a significant impact on the valuation of CEP.

Investors in CEP shares have tax implications

CEPs returns may be operating revenues or token returns. They are treated differently (ordinary income, capital gains, etc.). Tax professionals should be consulted by investors. The structure of the merged entity and the holdings of the tokens may make tax results complicated.

How interest rate shifts and inflation could affect valuation

Speculative growth stocks tend to lose their way in an environment of rising rates. Inflation pressures reduce risk appetite. CEP’s valuation multiples may compress if macro risk becomes the dominant narrative again.

Lessons from Past SPAC-to-Crypto Mergers

History informs us so that we can judge the possibilities of CEP better.

Performance patterns and investor outcomes from similar deals

Other SPAC-to-crypto transactions had outsize returns in case the management constructed actual platforms. Others collapsed when hype outpaced fundamentals. The track record is mixed; success leans toward disciplined growth over speculative leaps.

What CEP can learn from previous market cycles

Being conservative, having a transparent reporting, governing discipline, and communicating clearly, will make it through the downturns. CEP must avoid overpromising and underdelivering.

What Type of Investor Should Consider CEP Stock?

All investors should not rush in. This will assist you in making your judgment on whether CEP is a fit or not.

Ideal risk profile for CEP investors in 2025

CEP is appropriate to investors who can withstand volatility, who hold crypto infrastructure beliefs, and who have medium-to-long-term horizons. If your risk tolerance is low or you prefer stable income, CEP may feel too speculative.

Strategies to manage exposure — hedging, diversification, or timing

Use modest position sizing. Use options to define downside. You could also wait for post-merger results before scaling in.

Final Verdict — Is CEP Stock a Buy or Sell in 2025?

Having studied the technicals, fundamentals, and dynamics of merger of CEP stock, it is evident that the stock has high-upside potential with equally high-risk levels. Its future performance depends heavily on successful merger execution, crypto market stability, and investor sentiment. For 2025, CEP remains a speculative buy suited for investors who can tolerate volatility and think long-term.

Summary of bullish vs. bearish signals

Bullish: potential for scalable crypto services, institutional backing, positive market sentiment. Bearish: dilution risk, regulatory uncertainty, execution complexity, crypto volatility.

Expert viewpoint — what makes CEP a potential buy or avoid

CEP can attract speculative investors who are optimistic about the institutionalization of crypto, but it is not safe. If you seek steady income or low volatility, CEP is less suitable.

Decision framework for long-term vs. short-term investors

The long-term purchasers focus on essentials and control. Short-term traders lean on technicals and event catalysts. In both cases, use risk controls and clear exit rules.

Conclusion — Key Takeaways for CEP Stock Investors in 2025

On the intersection of traditional finance and the fast-evolving cryptocurrency market is Cantor Equity Partners, Inc. Class A Ordinary Shares (CEP stock). The stock is an opportunity and an uncertainty as 2025 unfolds due to its merger with Twenty One Capital and its growing exposure to digital asset infrastructure. Investors have to trade the persuasive growth narrative of the merger with the regulatory risks and dilution risks of SPAC-to-crypto transitions.

CEP stock could prove to be a good bet to long-term investors regarding the institutional adoption of services associated with cryptocurrencies. The business model of CEP can be considered as being strategically placed to scale up in the future by individuals who believe in the innovation of fintech and integration of blockchains. Short term traders must however remain alert of technical resistance areas, merger dates, and volatility because it can lead to sudden reversal of prices.

Simply put, CEP stock is not a passive holding, but an active investment that will pay off when you conduct research, choose the right time and risks well. The most appropriate action would be to continue to monitor key occasions in the corporate sector, monitor the mood of the population towards the crypto market, and diversify your investments in your portfolio. Knowing the key drivers behind CEP will make you make a wise decision, rather than an emotional one, be it in the purchasing, holding or simply spectator position.

FAQs — Common Investor Questions About CEP Stock

Q1. Is CEP stock a good buy in 2025?

Only CEP stock should be purchased by investors who are ready to take risks and believe that in the future, crypto-based financial services will be used more. It is a risky venture since the returns will greatly be influenced by the success of the merger, stability of the market and the success of the crypto world. Conservative investors may wish to wait with the outcome of the merger.

Q2. Should I buy CEP stock before or after the merger completion?

Provided that the deal is completed, making a pre-merger purchase would provide you with a larger opportunity to make money, although it might also be more risky than a post-merger purchase in the event that it collapses or is postponed. Post-merger purchases provide a better understanding of the performance of the merged company but might be at a premium after the uncertainty has been removed.

Q3. What risks could affect CEP’s growth trajectory?

Such risks as regulatory measures toward crypto companies, dilution through share conversion, ineffective integration of mergers, market fluctuations, and crashing of Bitcoin price are considered significant risks. All these may affect the valuation of CEP within a short period of time.

Q4. How does CEP’s merger impact existing shareholders?

Dilution to the existing shareholders may arise based on the merger conversion ratios and the post-merger share issues. Nevertheless, in case the merged organization is operationally successful, long run value may counter the short-term dilution impact.

Q5. What is the best investment strategy for CEP stock in 2025?

The most appropriate approach will be a diversified approach – narrow exposure, track the milestones of the mergers and place technical indicators as entry points. Do not over commit capital until CEP shows stable post-merger revenue.

Q6. Is CEP stock currently volatile and how should I track it daily?

The answer is yes CEP is very volatile because of merger news and crypto correlation. It is recommended to investors monitor it through trusted financial tools, create price warning signals, and review trade volume patterns to identify initial shifts in momentum.

Q7. How do I compare CEP to other crypto-linked SPACs?

Compare such factors as post-merger business model, percentage of dilution, estimated revenue and type of crypto exposure. The volatility of CEP is more than it is of many of its peers, but its upside can also be more in case of successful execution.

Q8. When are the next milestone dates (votes, lock-up expiries) for CEP?

Shareholders need to note future shareholder elections, SEC sanctions, redemption dates and insider lock-up expires. Such occurrences tend to bring about short term volatility and can change the sentiment rapidly.

Q9. What is CEP’s current institutional ownership level?

There seems to be institutional ownership that is limited but increasing. With the merger approaching completion and liquidity increasing, additional funds can start taking positions and this will stabilize the trading and enhance price discovery.

Q10: What is CEP stock’s current trading volume and liquidity outlook?

The volume of trading in CEP is average but will increase after the merger with institutional trading and free float growth.

Q11: Where can I find the latest CEP stock forecasts and analyst opinions?

Real-time predictions and change of sentiment can be tracked by investors on such websites as Nasdaq and Yahoo Finance.