Cantor Equity Partners (CEP) stock is also unnoticed by investors, but lurking behind the SPAC craze is a web of valuation and risk. Nevertheless, in contrast to other traditional companies, its price does not tell everything. You should go an extra mile on valuation, fundamentals as well as risks to find out whether the upside is there. The paper examines the structure, the recent performance, the valuation models, threat scenario, peer comparison, forward scenarios and trade logic of action of CEP.

| Metric | Value | Notes |

| Market Cap | $303M | Moderate SPAC size |

| Shares Outstanding | $12.8M | Dilution risk |

| Revenue | Varies | Pre-merger |

Table of Contents

CEP Company Overview & Corporate Structure

- Founded: 2020

- Employees: n/a

- CEO: Brandon Lutnick

- Website: n/a

At the current time, Cantor Equity Partners, Inc. does not have any important operational activities. The main targeting of the firm is to undergo either a merger, share exchange, purchase of assets, stock purchase, reorganization, or any other similar business amalgamation with a company or companies in a different industry, including financial services, healthcare, real estate, technology, or software.

It was originally called CF Acquisition Corp.It was established in 2020 and maintains its headquarters in New York.

Cep stock which was previously CF Acquisition Corp. The SPAC charter was reorganized to become A. Its mission is to identify and merge with or acquire operating businesses in sectors like fintech, technology, or real estate. But currently, it has no significant ongoing operations. Yahoo Finance+1

Since it is a blank-check vehicle, the actual value is on what company it can be merged with, and how the post-merger organization performs. The capital structure is key: CEP has 12.80 million shares outstanding and this has increased dramatically in the past year.

Dilution risks also exist through warrants or subsequent post-merger issue of shares, which can destroy value to the existing shareholders. Understanding that structure helps when making valuation assumptions later.

CEP Stock Recent Performance & Financial Snapshot

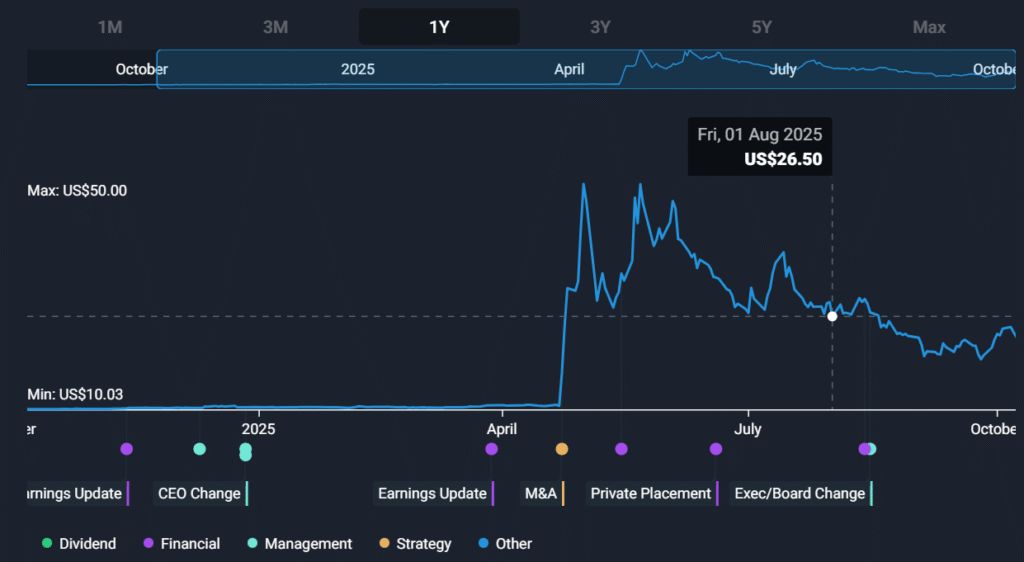

Cep stock has experienced extreme volatility in the recent past. Over the past 52 weeks CEP has shot up among its lows of approximately 10.03 to highs of over 50+ and then decays in an area of 20-30.

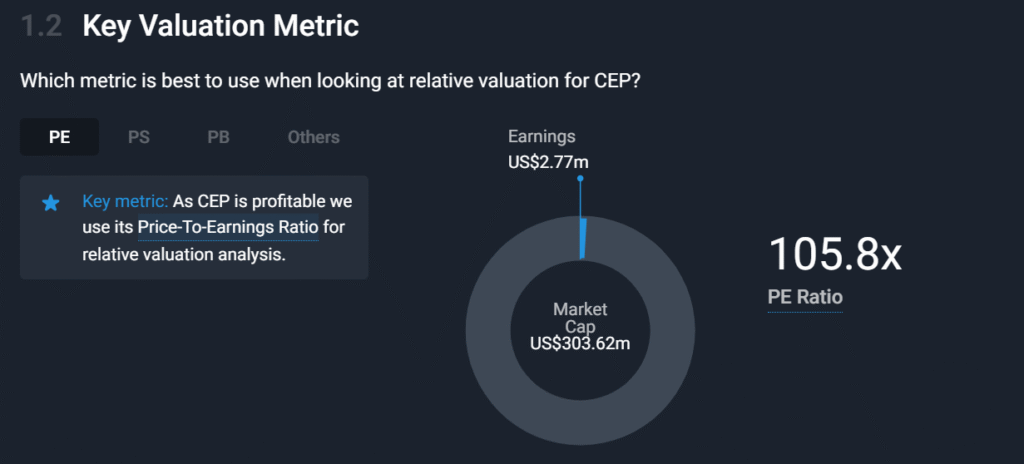

Under fundamentals, it registers zero revenue in the recent trailing periods. StockAnalysis Yet it recorded a net income of $2.77M (likely from non-operating gains) and an EPS of about $0.24.

On the balance sheet, CEP stock possesses approximately 104.5M assets and 107.1M liabilities or negative shareholders equity. This implies higher risk in its book structure.

This snapshot demonstrates an intermediate-not a fully mature business.

| Metric | Value | Notes |

| Shares Outstanding | 12.80M | Significant YoY increase |

| Revenue (TTM) | $0 | No recurring operations |

| Net Income | ~$2.77M | Largely non-operating gains |

| Assets | ~$104.5M | |

| Liabilities | ~$107.1M | Negative equity position |

The recent performance is driven by speculation not underlying operations.

Also read: CEP stock price forecast

CEP Stock Valuation Analysis

The conventional valuation ratios of CEP Stock Valuation & Forecast Insights are not informative as it is an SPAC. P/E is high (e.g. such as 100x) based on EPS that may include the non-operating profits. Neither Price-to-Sales nor D/E can be applied (no sales), nor is the negative equity distorted.

These ratios become meaningless and therefore, alternative methods of valuation can be more effective. One approach is asset backing plus merger valuation comparison: estimate what the target business is worth post-merger, subtract liabilities, then allocate equity value to CEP shares. The other technique is pro forma multiples- projecting revenue and profit of the merged company and the industry multiples.

Cep stock valuation must look beyond old metrics. Also, cep stock forecast today should reflect conditional scenarios rather than a single point estimate.

An example is when the target business has the ability to produce $50M of revenue and 10% profit margin, and you value the business in the market at 8x P/E, you back into a value of equity post-transact. Thereafter: Risk and dilution discount to come up with a valuation of CEP holders.

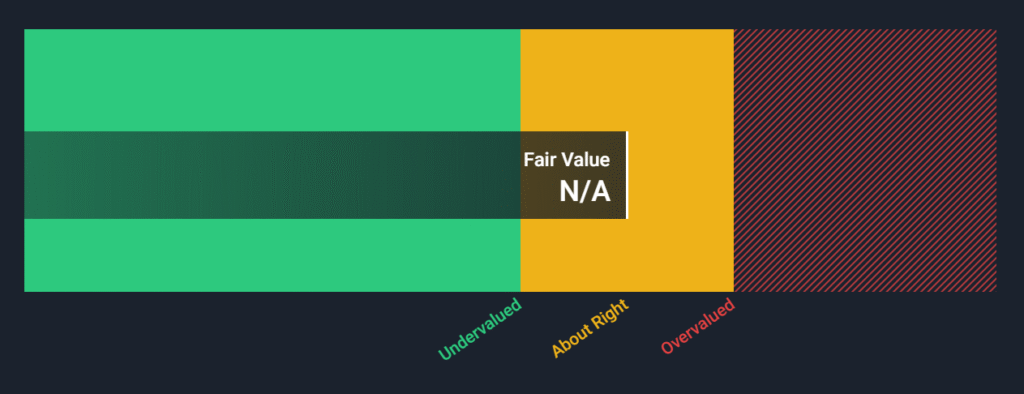

Is CEP Stock Overvalued or Undervalued?

In order to calculate this, we use a Discounted Cash Flow (DCF) model that calculates the present value of future anticipated earnings.

Peer & Industry Comparison

Analyzing the CEP alongside its peer SPACs gives investors a clearer picture of where it stands. Let’s take a look at two blank-check companies that are focused on acquiring fintech or tech firms.

From these comparisons, it becomes evident that the CEP carries more risk, tends to be more volatile, and is often valued with the expectation of significant growth. However, if its peers struggle after the merger, the CEP is likely to face the same fate. Observing how others perform after the de-SPAC process suggests that we should tread carefully with our forecasts.

Sensitivity & Scenario Modeling

Assumptions have an impact on valuation:

| Assumption | Value A | Value B | Estimated Share Value |

| Revenue growth (% per year) | 5% | 10% | $20 vs $30 |

| Profit margin | 5% | 10% | $1 vs $3 |

| Discount rate | 12% | 15% | _ |

Risks vs Reward: Trade Logic for Investors

The trade logic ought to be clear given that the risks and rewards are high. You could come in when the merger clarity arrives or when the fundamental of the target is revealed. Exit criteria could include structural red flags or failure to meet projected metrics.

This vehicle is suited for high-risk tolerant investors, not passive buy-and-hold. Only invest what you can afford to lose. Use stop-loss discipline.

Tools, Sources & Data Platforms

TradingView, Yahoo Finance, or S&P Global are also recommended to use in case of live data, charts, and fundamentals. On, for instance, you can follow the real-time chart of CEP. Such an external connection provides you with mighty visual aids.

Set alerts on key price levels, volume spikes, or filings (SEC S-4 statements). Use chart overlays to compare CEP’s performance vs peers or indices.

Summary of Key Takeaways & Investment Thesis

Cep stock is a speculative SPAC vehicle. The traditional valuation measures are ineffective tools, as there is a negative equity and zero operations. The actual value is based on merger target and post-merger implementation. However, in a bull scenario the stock has an upside in case the target is of good fundamentals.

My thesis: take CEP as a contingent opportunity. It will be appreciative as the merger is robust and first statistics superior to the anticipations. However, you should spend only a part of your capital and keep a check on it.

FAQs — CEP Stock Valuation & Fundamentals

What makes CEP’s valuation different from regular companies?

The P/E or P/S are not the correct values due to the lack of operations and negative equity. Rather, it depends on estimated post-merger measures and dilution.

Can CEP generate revenue before merger completion?

No. At present, CEP does not record any revenues. It gets its earnings by the non-operating sources or modifications of expenses.

How severe is the dilution risk in CEP?

It’s significant. Warrants, new issue of shares and recapitalizations following a merger can lead to a decrease in per-share value. Any prediction should take into consideration that dilution.

What fair value might CEP reach in a bullish scenario?

CEP would grow and multiply to up to $35-40+ as long as the merged company can justify its revenues as well as the margins.

Are CEP’s fundamentals strong enough to support future growth?

Not yet. The existent fundamentals are poor, negative equity, thin cash and no operations. The target business will be strong in the post-merger business.

Should a novice investor buy CEP stock?

CEP is more appropriate to the long term conservative investors who are well experienced risk-takers. Know the risks.

How much of CEP’s float is held by institutions

Recent reports of October 2025 suggest that the institutional investors already own approximately 59.79 percent of Cantor Equity Partners (CEP) shares, this is as compared to 36 percent of the past quarter.