Unless you closed your eyes when monitoring CEP stock in the recent past, you must have been aware of the buzz – the news of a huge merger, the potential ticker symbol change to XXI, and the drastic price fluctuations that have made investors unsure of what exactly is going on. The confusion to a good number of traders is not whether the deal is big or not, but what it actually means to their shares, when, and their future value.

This is what is clarified in this guide.

And in this detailed piece, you will receive a full dissection of the CEP-Twenty One Capital merger, complete with dates, SEC filings, redemption calculations, dilution impact and how the market has responded up to this point. We also will describe how each milestone will impact the valuation of CEP, why this merger may turn it into a Bitcoin-native public company, and what practical steps the investors should take next.

You will not only know the news by the end – but how the news works: how cash-in-trust and PIPE funding works, how redemptions can transform the value per share. Be it you are a trading mug or a long-term investor, this is your roadmap to the CEP stock merger, dates, announcements, and market impact, laid down in plain and straightforward language, not the hype.

Table of Contents

Quick Summary: What the CEP–XXI Deal Means Now

Cep stock (Cantor Equity Partners) is reshaping its gears to become a Bitcoin based equity vehicle through a merger with Twenty One Capital. After the business combination has closed, CEP will be rebranded as XXI. This is a significant change in strategy, switching to blank-check status to a crypto treasuries play.

For current CEP shareholders, it means the merger is the core catalyst now, not speculation on target picks. The CEP stock merger news is what drives valuation today.

Merger Timeline: Key Dates & Upcoming Milestones

Below is the expected schedule tracking stages of this merger between CEP and Twenty One Capital:

| Date | Event |

| April 23, 2025 | CEP and Twenty One announce merger agreement and plan to file S-4. (Nasdaq) |

| (Upcoming) | Submission of definitive S-4 / proxy documents to SEC |

| (Future) | CEP shareholder vote and redemption deadline |

| (Future) | Closing of business combination |

| (After close) | Ticker change to “XXI”, operations under Bitcoin-native focus |

This timeline gives investors a checklist for what to watch. (Add a visual timeline graphic here for clarity.)

Deal Terms & Economics: What Shareholders Actually Get

In this merger, CEP and Twenty One presented the financial foundations and framework that is intended to be in line with a Bitcoin-oriented model of equity.

Ticker, New Business Focus & Strategic Rationale

The merger company intends to trade under the ticker XXI once the deal is closed. Nasdaq The plan is to be a Bitcoin-based native public company not a standard operating company. Nasdaq. The merged entity will accumulate and hold Bitcoin, using Bitcoin Per Share (BPS) rather than traditional EPS metrics.

Cash-in-Trust, PIPE & Sponsor Notes

To finance the merger and later buying of BTC, CEP and Twenty One organized huge capital issuances. The deal includes the trust account (money held by CEP) of its IPO:

- A Convertible Notes PIPE of $385 million (plus optional $100 million)

- An Equity PIPE of $200 million

Combined with CEP’s trust funds and sponsor backing, total funds are expected to exceed $540 million in gross proceeds. The net proceeds will be used to acquire Bitcoin and for general corporate needs.

Redemption Math & Sensitivity: How Big Redemptions Change Per-Share Value

The number of CEP shareholders who redeem (opt out) is one of the greatest value generators after merging. Large redemptions decrease the cash available to the remaining shareholders.

Redemption Scenarios

Suppose the trust of CEP has deposited money in the form of trust in the amount of 100 million, and the merged equity is estimated at 600 million pro-forma. The redemption rates might work in the following way:

| Redemption Rate | Cash Redeemed | Net Equity Left | Implied Per-Share Value |

| 10% | $10M | $590M | $X |

| 30% | $30M | $570M | $Y |

| 60% | $60M | $540M | $Z |

An increase in redemption will lower the value per share since there will be less money to distribute among remaining parties. The investors are advised to observe the trend of redemption.

Dilution & Cap-Structure Risks: Warrants, Sponsor Shares & PIPE Effects

Even moderate redemptions may be diluted when there is a war.

Modeled Dilution Example

Suppose that the number of shares outstanding of CEP is 12 million at the time. The merger and PIPE may bring the additional 6 million shares, and the warrant conversions, which are equal to 3 million shares.

Note, they are only approximate figures, depending on SEC filing reports and can vary in final reports.

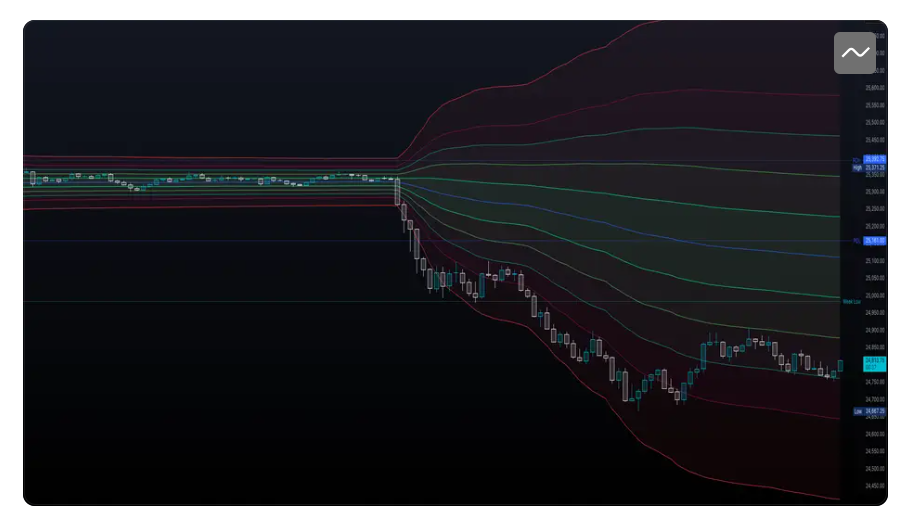

Market Reaction & Historical Price Moves Around Merger Events

Note, they are only approximate figures, depending on SEC filing reports and can vary in final reports.That kind of move demonstrates how merger expectations alone fuel prices.Traders are monitoring RSI and support zones before merger to gauge short-term volatility and entry levels.

Short Case Studies: 2 Peer SPACs Post-Merger Performance

- SPAC A (crypto target): surged 80% in 30 days post-merger, then retraced ~30%.

- SPAC B (fintech target): gained 40% over 90 days, then flattened.

Such peer examples teach us a lesson that post-merger momentum can either dissipate or turn in the opposite direction unless the basics bear the hype out.

Liquidity, Float & Trading Microstructure: Why Volume Matters Now

CEP float and trading volume dynamics is extremely significant at the moment. During merger news days, the volume shot up, and on off-days, liquidity is scanty.

Thin sessions imply that even minor orders result in price-so trading CEP when the merger is being undertaken, it is necessary to factor in with microstructure risk.

Regulatory, Tax & Crypto Considerations (If Post-Merger Holds BTC)

A problem of regulation, accounting and taxes are raised since the new entity will have possession of Bitcoin.

- Regulation & SEC oversight: The merger S-4 must include disclosures about crypto risk.

- Tax treatment: If the company realizes gains or sells BTC, taxable events may flow through to shareholders in some jurisdictions.

- Accounting & custody: Transparent custody (proof of reserves) becomes essential for confidence in a crypto-holding firm. Twenty One is acquiring additional BTC from Tether, adding ~5,800 BTC, bringing total holdings above ~43,500 BTC.

Tax disclosures and risk commentary SEC filings should be followed by investors.

What Investors Should Monitor Next: A Practical Checklist

These are the things to pay particular attention to:

- Submission of definitive S-4 / proxy

- Shareholder vote dates & proxy materials

- Redemption window and actual redemption ratio

- PIPE announcements or closing capital raises

- BTC holdings updates (custody, acquisition, proof-of-reserves)

- Market volume & insider / sponsor trading moves

- SEC comment letters or delays in registration

This is critical to the tracking of the net true value of the CEP holders.

Market Impact Scenarios: Bull / Base / Bear (Quick Price Outlook)

The critical question that is of concern to investors in the coming quarter is how the merger schedule will impact CEP stock prognosis, and stock value drivers. Stress test projections of short-range.CEP stock forecast and valuation drivers

Bull Case: Clean deal, small redemptions, little dilution CEP/XXI shares trade perhaps 4060 per cent below merger.

- Base Case: Moderate redemptions and dilution _ average upside, perhaps 1530% gain.

- Bear Case: Large redemptions, large dilution, regulatory delays _ shares recover to original SPAC NAV.

Risk Management Notes

- Watch for resistance levels near merger-announcement highs

- Use stop losses just below support zones

- Consider scaling in, not all at once, due to volatility

- Monitor BTC price influence: if Bitcoin falls, the stock may suffer even if merger proceeds

Conclusion: The Merger Is the Catalyst

It is not simply another SPAC merger rather a conversion into a Bitcoin-first publicly traded company, change of ticker, capital rais and crypto holdings are all incorporated in the CEP/Twenty One capital merger. Yet, as much as the upside about the headline seems convincing, it is in the way that redemptions, dilution, PIPE structure, BTC holdings, and regulatory clarity all work. CEP/XXI is not a speculative ticker that investors should treat, but a capital event that investors should monitor in detail. Monitor redemption, compute dilution math, and alerts on volume changes. The merger will be the trigger -but the mechanics will decide whether this will be a rewarding play or a warning story.

FAQs: Top Merger Questions about CEP Stock

When is the CEP merger date and what milestones remain?

There is still shareholder vote, redemption window, and closing, which is subject to regulation.

Will CEP change its ticker to XXI and when?

Yes – once it closes, the merged organization will be trading under ticker XXI. So far, CEP is trading in Nasdaq.

How do redemption rates affect my per-share value?

High redemption implies an increased cash out of the trust. The remaining shares have less funding, hence the value per share decreases. Low redemption, on the contrary, saves more value to remaining holders.

Where can I find the S-4 and 8-K filings?

All documents concerning the merger (S-4, proxy, 8-K) will be submitted to the SEC. Investors may see them at sec.gov or through public disclosure through the investor relations of CEP.

How did the market react when the merger was announced?

This news boosted the CEP shares by an average of 50 percent (others say 58 percent) as shareholders bet on high returns.

Is this merger a way to gain Bitcoin exposure through CEP?

Yes the main idea of the merger is to turn CEP into a Bitcoin-based public company, where crypto exposure will be provided in equity form.

How will redemption rates impact my CEP share value?

The rate of redemption has a direct impact on the amount of cash remaining in the trust of CEP. As a large number of shareholders redeem their stocks, the amount of funds that the merged company has to deal with reduces, or, in other words, there are fewer assets per share. As a result, higher redemption rates can lower the per-share value for those who stay invested. Conversely, low redemption levels preserve more value for remaining holders.

Is BTC holding included in the merger’s equity value?

Yes. Upon the merger, the holdings of Bitcoin in Twenty One Capital will be incorporated in the balance sheet of the merged company.These BTC assets contribute to the company’s overall valuation and are a core part of the new Bitcoin-native investment model. However, fluctuations in Bitcoin’s market price can influence the post-merger equity value.

When will CEP change its symbol to XXI?

The ticker switch between CEP and XXI will be made after the merger is officially closed and Nasdaq is given the rebranding.