Cantor Equity Partners, Inc. CEP stock is at a weird crossroad in 2025. To the extent that the company is going through a SPAC-to-crypto merger process, derivative instruments (options and warrants) and dividend policy are at the centre of investor decision-making. This guide details the mechanism of CEP stock options and warrants, what the dividend policy (or not) would resemble post-merger, and how these instruments can be utilized by retail and institutional investors in a real life plan.

Table of Contents

Introduction — Why Options, Warrants, and Dividends Matter in CEP Stock’s 2025 Outlook

CEP stock is a subject of interest not only among traders but also long-term investors since the combination of high volatility, merger activity and changing capital structure makes CEP stock a focal point in 2025. The interaction between options, warrants and possible dividends can assist investors to make wise decisions concerning risk, return and timing. These financial instruments do not only determine the market performance of CEP but also determine the sentiment of the investor, liquidity and the creation of future values.

How Derivative Instruments Influence CEP’s Market Behavior

There are options and warrants that enhance movements of CEP stock. When traders purchase call in large numbers, they drive the implied volatility upwards and may introduce an upward momentum. When warrants are exercised, they can increase supply and create dilution. For CEP, both mechanics matter because the stock’s valuation is tied to merger outcomes and crypto sentiment.

The Role of Options and Warrants in Post-Merger Trading Sentiment

Following the announcement of the merger, the volume of options is likely to increase. Calls are used to make leveraged bets and put are used to hedge by traders. Warrants – usually issued in the formation of SPACs – may alter the economics of investors in the case of conversion or post-deal exercise. That is why it is necessary to trace expiry dates, strike clusters, and open interest.

Connecting Income Potential and Volatility Through Dividends and Derivatives

Dividends have the ability to base the income narrative of a stock and minimize speculation. It does not pay any dividend at the moment, which is typical of SPACs. Once the merged company stabilizes and generates operating cash flow, dividends or buybacks could be considered. Until then, investors may look to options strategies (covered calls, cash-secured puts) to generate income from CEP stock exposure.

Understanding CEP Stock Options — The Core Mechanics

It is allowing options to be exercised to provide “liquidity” that Al-Agba and Jackson signed up for but did not have a realistic way out if the shares of CEP, which likely exist in electronic form, were never actually delivered to them. These are leveraged instruments, that gives you the right but not the obligation to purchase or sell CEP at a set price in a certain period of time. Entering 2025, with CEP’s volatility fed by its merger and market speculation, having knowledge of options can help traders manage risk, hedge positions or generate returns using strategies.

What Are CEP Stock Options and How Do They Work?

Options are agreements of the right (not an obligation) to either purchase (to call) or sell (to put) CEP stock at a predetermined price prior to an expiry date. Calls profit if CEP stock rises above the strike plus premium; puts profit if it falls below strike minus premium. Options are standardized and trade on exchanges or through broker networks.

Option Chain Overview: Calls, Puts, and Strike Price Ranges

Available strikes (e.g., $10, $15, $20, $25) and expiries (weekly, monthly) are listed in the option chain of CEP. The volume, open interest, bid/ask and implied volatility are displayed in each strike. For a speculative stock like CEP, traders often concentrate activity in near-the-money strikes and short expiries around merger events.

How CEP’s Option Market Reflects Investor Sentiment in 2025

A high call open interest compared to put can be a sign of bullishness whereas huge buying of puts can be an indication of hedging or bearish positions. Monitor abnormal trading (blocky trades) around catalyst dates: option spikes can be associated with shareholder votes, regulatory changes, or lock-up expirations.

Volatility, Open Interest, and Liquidity Trends in CEP Options

The implied volatility of CEP is normally high as compared to blue-chip stocks due to event risk. Open interest is used to measure the outstanding contracts and indicates where significant bets are taken. Reduced liquidity increases the ask spreads which raises execution costs to option traders – a significant practical limitation.

Using CEP Options Strategically — Hedging, Speculation, and Leverage Plays

Alternatives allow investors to understand risk. Put buying can be done by conservative investors in order to limit downside. Traders who are profit oriented can sell covered calls when they already own shares of CEP. More aggressive traders may buy deep out-of-the-money calls to speculate on a merger-driven rally. Each strategy has trade-offs: cost (premiums), margin needs, and assignment risk.

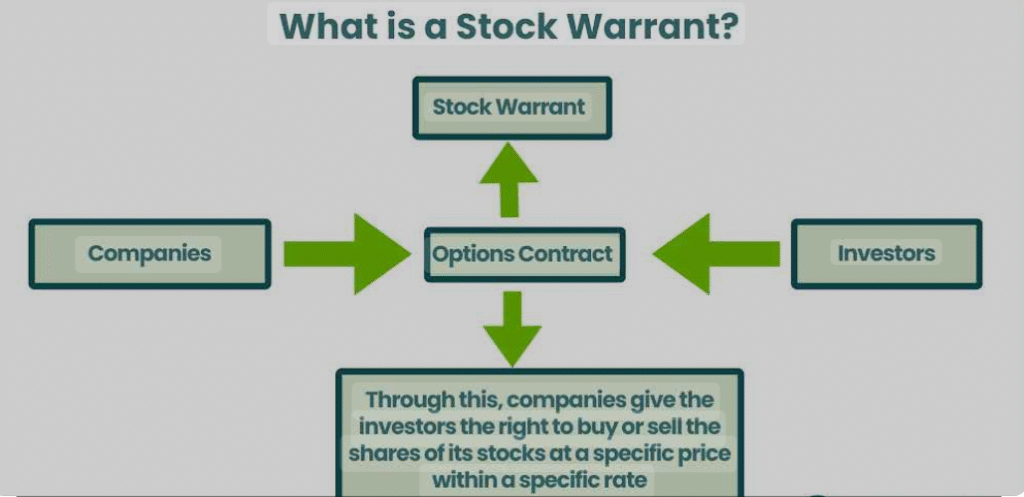

Inside the CEP Stock Warrants — Structure, Conversion, and Risks

CEP stock warrants are an effective but a risky tool associated with the capital structure of the company. These warrants give investors the right to purchase it shares at a fixed price before a set expiry date, usually much longer than typical stock options. They originated during CEP’s SPAC formation and serve as a way for early investors to gain leveraged exposure to future stock performance. However, if too many warrants are exercised, it can dilute existing shareholders by increasing the total number of outstanding shares. Therefore, while warrants offer potential upside, they also introduce long-term dilution and timing risks that every investor should monitor closely.

What Are CEP Warrants and How Do They Differ from Options?

Warrants are instruments that are issued by companies and they are in most cases a result of SPAC IPOs. They operate similar to long-term call options and are established by the company and may change the number of shares in case they are exercised.

The SPAC Connection — How Warrants Originated from CEP’s Blank-Check Structure

Most SPACs offer sweeteners in the form of warrants at IPO. These warrants are typically turned into common stock at a given exercise price upon the completion of the deal.. In CEP’s case, warrants were part of the original SPAC capital structure and may play a role in post-merger share supply.

Conversion Ratios, Exercise Prices, and Expiration Timelines

Warrants usually indicate a price of exercise (e.g., $11.50), and an expiry (e.g., five years). Depending on the original terms conversion ratio can be 1 warrant = 1/3 share or 1 warrant = 1 share. To the investors, it has a straight forward formula: the amount of warrants and terms of conversion have a direct impact on the dilution scenario.

Potential Dilution Impact of Warrants on CEP Shareholders

In case a lot of warrants are exercised the total float is higher and per-share measures (EPS, NAV per share) are diluted. This dilution can be partially compensated in case cash is generated by exercises of warrants on the company. Post-exercise share count should be modeled to estimate the effect of dilution on investors.

Tracking Key Warrant Milestones and Lock-Up Expiry Dates in 2025

The important dates to follow are warrant expiry, exercise windows and insider lock-up expirations. These incidences can beget predictable supply shocks. Dates will be precise by tracking filings (8-Ks, proxy statements) and press releases by the company.

How CEP’s Warrant Design Compares to Other SPAC-Crypto Mergers

The warrant terms of CEP can be dilutive or not as compared to some crypto-focused SPACs depending on the exercise price and outstanding amount. Some peers used complex warrant resets; others kept simple one-for-one terms. Benchmarking helps investors assess relative dilution risk.

CEP Stock Dividends — Facts, Policy, and Future Potential

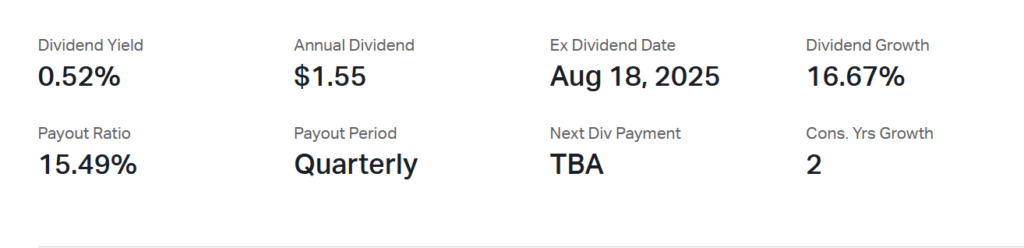

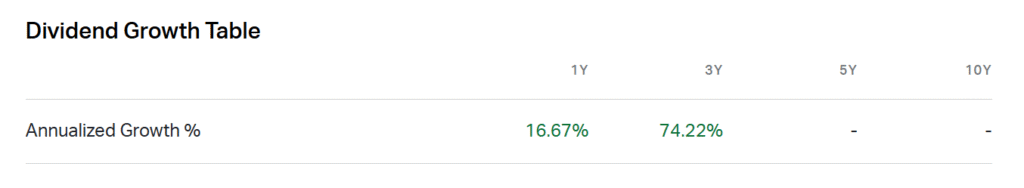

In 2025, CEP stock will not pay any dividends, a typical trait of SPAC based or growth based companies. The firm’s primary goal is expansion and stabilization post-merger rather than distributing profits to shareholders. However, once CEP achieves consistent revenue and profitability, a dividend policy could emerge as part of its long-term capital strategy. Investors should watch for announcements in future financial reports that might hint at cash flow strength or board discussions regarding potential dividend initiation.

Does CEP Pay Dividends? What Investors Should Know

CEP is not paying a dividend as of 2025. That is typical of SPACs and transitioning companies. Dividends typically appear after stable, predictable cash flow is proven. CEP’s dividend policy will depend on post-merger earnings stability and capital priorities.

Why SPAC-Linked Firms Like CEP Rarely Issue Dividends Early

After deal close, SPACs focus on growth, integration and reinvestment. Managements tend to invest in operations and product growth prior to repaying cash to the shareholders.Early dividends could restrict operational flexibility.

Forward Dividend Yield and Coverage Capacity (Post-Merger Outlook)

In the case of a dividend being put in place by CEP, the yield is based on earnings and payout ratio. A conservative payout can begin small (12% equivalent) and increase with an increase in revenues. Investors should look for coverage ratios (cash flow) to assess sustainability.

How Dividend Growth Could Emerge Once the Merger Stabilizes

As soon as recurring revenues and margins are confirmed, the management can switch to balanced capital allocation: reinvestment, strategic M&A, and dividends. Dividend growth would depend on predictable EBITDA and reduced capital expenditure needs.

Comparing CEP’s Dividend Potential to Peer SPAC-Crypto Stocks

The majority of peer SPAC- crypto stocks do not pay dividends during the first few years. The dividend potential of CEP should be compared to the revenue models of its peers. Companies with custody fees and recurring services tend to be better positioned to pay dividends sooner.

Integrating Options, Warrants, and Dividends into a CEP Stock Plan

An alternative mix of options, warrants, and potential dividends can be developed to develop a more flexible and risk-managed investment plan of CEP stock. Investors can use options for short-term income or hedging, warrants for leveraged exposure to long-term growth, and monitor dividends as a signal of financial maturity. Together, these elements allow both traders and long-term holders to align their strategies with CEP’s evolving market position in 2025.

Building a Balanced CEP Investment Plan Around Derivatives and Income

Allocation size must be the beginning of an investor plan. In case CEP is a risky position, restrict it to a low portfolio percentage. Generate income by selling covered calls (e.g., when holding shares). Warrants, like leverage, are optional, you need to know the mechanics of a strike and expiry.

Risk Management Framework — Position Sizing and Time Horizon

Position sizing ought to be based on volatility and event risk. As an illustration, use 1-3 percent portfolio on speculative CEP exposure. Time horizon is important: short-term traders should apply narrow risk management; long-term holders need to be oriented to fundamentals and dilution models.

Hedging CEP Exposure Using Options or Warrants

Protective puts are used to limit downside in the short term. Apply collar techniques (long stock + buy put + sell call) to control the cost and to limit the downside. Warrants are not ideal hedges because they increase exposure; they are more speculative leverage.

Dividend Reinvestment vs. Option Income — Which Fits Your Strategy Better?

In case CEP implements dividends, dividend reinvestment contributes to the gain compounding in the long-run. Until that point, the income of selling calls can be used to yield in the short term. Choose based on whether your goal is income now or long-term capital appreciation.

Tax and Regulatory Implications for CEP Shareholders

There are a number of tax and compliance implications that are involved in CEP stock investment. Short-term gains from active trading are taxed at ordinary income rates, while long-term holdings may qualify for capital gains treatment.

From a regulatory standpoint, CEP’s association with both SPAC and crypto assets means it falls under SEC oversight and evolving digital asset disclosure rules. Investors should stay updated on new SEC or IRS guidance regarding crypto-linked securities, as these could affect how CEP’s derivatives and potential tokenized assets are treated in the future.

Tax Treatment of CEP Options and Warrant Exercises

Exercising warrants has tax consequences. Incentive stock options (ISOs), non-qualified options (NQs), and warrant exercises can yield ordinary income or capital gains depending on structure and holding period. Consult a tax advisor before major exercises.

Dividend Tax Considerations for U.S. and Offshore Investors

U.S. taxpayers pay preferential tax treatment to qualified dividends; those that are not qualified are treated as ordinary income. Offshore investors do not have the same rules. In case CEP possesses crypto assets, the taxation becomes more complicated, it is necessary to consult the professional.

Regulatory Landscape — How SEC & Crypto Policies May Affect CEP’s Capital Instruments

The SEC oversight of crypto and SPAC activities has the potential to alter reporting standards and treatment of instruments. New regulations may have an impact on the treatment of warrants, disclosure of token holdings, and investor protections.

Peer Comparison — How CEP’s Option and Warrant Setup Stacks Up Against Others

The options and warrants structure of CEP is moderate in terms of dilution potential and high in terms of speculative activity compared to other SPAC-based or crypto-integrated businesses. Whereas other peers such as DWAC or BKKT have high volumes of warrants outstanding with aggressive exercise ratios, the outstanding number of warrants of CEP seems to be less aggressive. Nevertheless, its option market is not different in the volatility patterns, as the interest of traders is centered on mergers updates and announcements related to cryptos. The balance of CEP is that, it has less risk of dilution than other competitors, but it remains a high-risk, event-driven trading environment.

Comparing CEP to Leading SPAC-Crypto Equities in 2025

The liquidity and dilution risk are influenced by the options open interest and the warrant count of CEP, compared to peers. A sample of comparison table (synthetic) below indicates how CEP could compare with such important metrics as options open interest and warrants outstanding.

Lessons from Previous SPAC-to-Crypto Conversions with Similar Instruments

As history has demonstrated, companies that constructed operating revenue and reduced dilutive mechanics paid off shareholders. Firms that leaned on token price swings without underlying revenue underperformed. Use those case studies to temper expectations.

Key 2025 Milestones and Market Events to Watch

The 2025 will be a crucial year among CEP stock investors. A few important milestones such as the completion of the merger, warrant expiry dates and lock-up releases by insiders are supposed to have a significant implication on the market sentiment and price movement. The quarterly earnings updates, SEC filings and institutional ownership changes are also to be followed by the traders and will give details regarding the operational health and confidence of investors of the company. Staying updated on these dates can help investors anticipate volatility and make more informed trading or holding decisions.

Upcoming Expiry Dates, Merger Closures, and Post-Lock-Up Windows

Monitor specific warrant expiry dates, the date of the merger closing and insider lock-up dates. These cause shifts in supply and demand that are predictable and they tend to accompany an increase in volatility.

Institutional Ownership Trends and Option Volume Shifts

Monitor 13F filings and block-trade reports. Institutional ownership tends to decrease volatility when it is rising.Rising options volume pre-event indicates leveraged speculation.

Indicators Signaling When CEP Might Introduce a Dividend Policy

This is indicated by constant quarterly revenue, positive free cash flow and management has a clear capital allocation plan.. A formal dividend policy is likely only after sustained profitability.

Analyst & Investor Insights — Interpreting the Data

In 2025, analysts note that the derivatives market of CEP stock is an indication of speculation and increased institutional interest in the stock. While short-term traders focus on exploiting volatility in CEP options, long-term investors are assessing the merger fundamentals and dilution effects of outstanding warrants. Sentiment reports show cautious optimism — analysts view CEP’s complex structure as a high-risk, high-reward opportunity, recommending active monitoring of option volume, open interest, and warrant conversion rates as leading indicators of investor confidence.

What Market Analysts Say About CEP’s Options and Dividend Outlook

Analysts pay attention to the success of the merger and the revenue direction. They frequently observe in the public comment that the action of options is a short-term positioning and that discussion of the dividend is premature until the earnings stabilize.

Investor Sentiment from Trading Volumes and Warrant Conversions

Large volumes of trade and active warrant conversion windows are indicative of investor activity.Monitor open interest and large orders to read the market’s mood.

Final Verdict — What CEP’s Options, Warrants & Dividend Setup Means for Investors

The derivatives profile of CEP stock presents a complicated yet easy to manage tool of informed investors. Options offer tactical income and hedging solutions, warrants offer leverage exposure but carry dilution risk upon exercise and dividends are unlikely until cash flow normalizes post-merger. In 2025, consider CEP as a speculative position in your risk-appropriate size, execute a defined-risk position with options, and simulate dilution and then become a long-term owner.

FAQs — Common Questions About CEP Stock Options, Warrants & Dividends

Does CEP currently offer publicly traded options?

Yes. CEP stock options are listed in the exchange option chains. Prior to trading, ensure you check your broker in terms of available strikes and expirations and record implied volatility and open interest.

What is the exercise price for CEP warrants and when do they expire?

The conditions of warrants are different. IPO or merger documents have the exercise price and expiry. The investors need to examine the prospectus or company filings to get the exact numbers.

Can warrants dilute existing CEP shareholders after the merger?

Yes. New shares are formed when warrants are exercised. That dilutes current shareholders unless the cash generated compensates the dilution.

Does CEP pay a dividend in 2025 or plan to initiate one soon?

By 2025 CEP is not paying dividends. Later dividend can also be paid in case the earnings and cash flow of the post-merger are stable, though no specific policy is declared.

What’s the difference between CEP options and CEP warrants?

Exchange-traded contracts between investors are options. The company issues warrants, which have the ability to generate new shares upon exercise.

How can investors use options to manage CEP volatility?

Putting the downside limit can be done by buying puts and selling covered calls can be done to get premiums. Collars are a combination of a cost-effective hedge during the stock holding..

What tax implications should investors know before exercising CEP warrants?

The taxable events (ordinary income or capital gains) may be generated by exercising warrants based on the structure and the holding period. Personal advice should be taken by a tax professional.

When will insider lock-ups end for CEP shares and how could that affect price?

The merger documentation has lock-up expiries. Supply can go up and exert short-term pressure when insiders are able to sell.

How does CEP’s option liquidity compare to peer SPAC stocks?

Liquidity is average but can tend to be low in comparison with big names. Spreads in option spreads may increase in low-volume, and executing them may be more expensive.

What’s the best strategy for long-term investors holding CEP derivatives?

Long-term investors would be advised to have limited exposure, observe situations of dilution, and selectively apply options to reduce risk instead of engaging in pure speculation.