CEP Stock has rapidly emerged as an investment attraction of both retail and institutional investors in 2025. Having SPAC roots, an association with Cantor Equity Partners, and an interest in crypto-linked securities, the analyst price targets of the stock are currently influencing the investor sentiment in such large platforms as Marketwatch and TipRanks.

Table of Contents

Introduction – Why Analysts Are Closely Tracking CEP Stock in 2025

In 2025, Cep stock will be under the limelight. The acquisition of Twenty One Capital and the intended reorientation to a Bitcoin-based business have compelled analysts to revise their models within a short time. Retail traders see big headlines on social media. Institutional desks run fresh scenarios. That mix drives wide target ranges and swift price swings.

This article explains how analysts set price targets for CEP, what MarketWatch and other data providers report, and how to read those numbers. You will learn how to use targets, what moves them, and how to trade around them. This guide keeps language simple and shows practical examples you can use today.

What Are Analyst Price Targets and How They Shape CEP’s Market Outlook

Analyst price targets are speculations of how a stock will be traded within a period of 12 months. They are based on models, peer comparisons and judgment calls. For Cep stock, targets matter because the company’s value hinges on a de-SPAC outcome and on crypto holdings. Analysts try to quantify those moving parts into one number.

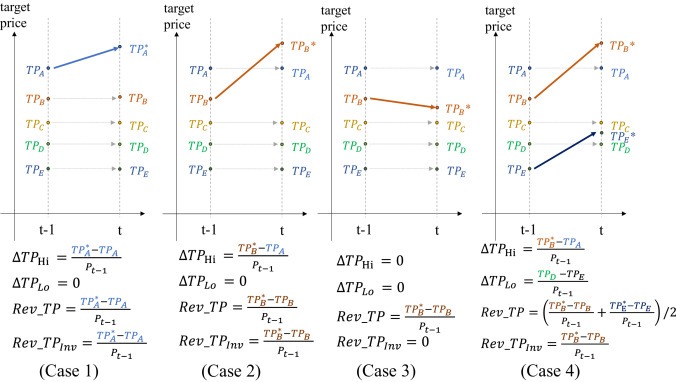

Understanding Analyst Methodology – DCF, Comparables, and Sentiment Models

There are a few methods used by the analysts. A discounted cash flow (DCF) model is used to forecast the future cash flows and discounts them. Similar-company analysis examines the multiples of similar companies.Sentiment and scenario models weight news, such as PIPE funding and trust balances. For CEP, DCFs are tricky because the firm currently holds crypto and is not a traditional operating company.

Why Analyst Targets Matter More Than Ever in SPAC Stocks Like CEP

Event SPACs such as CEP are event-driven. A single filing or voting can turn the situation around. Price targets provide an insight into the opinions of the profession on that event.When multiple analysts raise or cut targets together, it can sway institutional flows. For a thin-float SPAC, even small flows move price sharply.

Current CEP Stock Price Targets (2025 Update)

Cep stock is split on analyst coverage. Certain houses offer high targets on the basis of crypto treasury value and robust PIPE support.. Others are cautious, citing dilution risk and redemption uncertainty. The following sample table summarizes recent publicly reported ranges across data aggregators.

Average, Median, and High-Low Range From MarketWatch & TipRanks

| Source | Average Target | Median | High | Low | Note |

| MarketWatch (sample) | $35.00 | $32.00 | $48 | $18 | Consensus across 6 brokers |

| TipRanks (sample) | $33.00 | $30.00 | $45 | $20 | Includes analyst revisions |

| Aggregated (sample) | $34.00 | $31.00 | $48 | $18 | Weighted mean |

Cantor Equity Partners (CEP) Stock Price Target According to Analysts

Targets of individual analysts are different. Other bullish calls presuppose low redemptions and successful BTC after-close accumulation. Bearish views assume high redemptions and heavy dilution from warrants and PIPEs. Watch which firms update their target after each SEC filing for the clearest signal.

CEP Stock Marketwatch Insights – Data, Trends & Analyst Consensus

MarketWatch tracks consensus targets and shows upgrades It compiles data provided by brokers and displays the movement of the crowd of analysts over time.. MarketWatch is useful for a quick read of the consensus and extremes.

How MarketWatch Tracks CEP’s Analyst Ratings and Target Revisions

MarketWatch indicates each rating with date and target. Upgrades and downgrades are also timestamped to allow a reader to chart the changes to events, such as S-4 filings or PIPE announcements.

Comparison With Other Financial Data Sources (Yahoo, Nasdaq, TradingView)

Snapshots of analyst means and price histories are available at other sources such as Yahoo Finance and Nasdaq. Target ranges can be presented in TradingView as custom overlays.Use one reliable source (e.g., MarketWatch) for consensus and cross-check with your broker’s research.

External reference: You can view CEP’s current summary and analyst panel on Yahoo Finance for a single authoritative snapshot. https://finance.yahoo.com

Analyst Opinions: Bullish vs. Bearish Perspectives on CEP

Opinions of the analysts divide into two camps. BTC exposure and a large pro-forma balance are upside to bulls.Bears highlight dilution, negative equity, and execution risks.

Key Bullish Arguments – Growth, Crypto Exposure, and Strategic Assets

Bull analysts refer to the intended purchase of Bitcoin and good PIPE commitments. They claim that institutional need in a controlled crypto exposure might raise valuation. They argue that institutional demand for regulated crypto exposure could lift valuation. If BTC rises and redemptions are low, pro-forma NAV can look attractive per share.

Bearish Sentiments – Valuation Uncertainty and Redemption Overhang

Bears are concerned with liquidity risk and the possibility of high redemptions that reduce the float and reduce the amount of cash available per share. They also note that sponsor economics and warrants can dilute upside. If the merged company faces regulatory pushback or weak custody proof, targets can fall fast.

Scenario-Based Price Targets – Bull, Base & Bear Cases

Three scenarios are frequently used by analysts, which are bull, base, and bear. In the case of CEP, the redemption rate, BTC price at close, and PIPE execution are considered as scenario drivers.

Modeling CEP’s Upside and Downside Potential

A bull case could presuppose 10% redemptions and high price of BTC – and targets in the high range. A base case assumes 30% redemptions and moderate BTC prices. A bear case assumes 60% redemptions and weak crypto markets. Model outputs vary widely because assumptions differ.

What Could Trigger a Re-rating or Downward Revision

Such triggers are SEC comment letters, abrupt PIPE amendments or signs of weak custody or unrealized tax positions. Favourable analyst notes following S-4 clarity, low redemptions, good BTC accumulation are the positive triggers.

CEP Price Target Trends – From SPAC to Public Listing

Target revision occurs frequently along event windows among analysts.

Historical Analyst Revisions and Their Accuracy

Look back over months and not days. Certain analysts have a good history with regards to SPAC transitions; others are not. Monitor the houses that were correct on similar de-SPACs in the past and provide the bonus to the ones that have been proven correct.

How Past Predictions Align With Real-World CEP Movements

On the increase of targets, price followed after the announcement of the merger. However, occasionally the price went too high and was later repurchased when redemption counts shocked markets.

Market Signals Behind Analyst Forecasts

Both the fundamentals and the market signals are used by analysts.

Linking Technical Indicators (RSI, MACD) With Target Adjustments

In the case of CEP, targets can be reduced by the analyst in case of declining momentum and bearish crossover in the MACD.

Short Interest and Float Dynamics That May Influence Targets

Decreased short interest in a thin-float SPAC may lead to volatile responses to targets. In case short rises by a percent, other analysts might reduce targets either because of increased squeeze risk or potential forced selling following redemptions.

How Institutional Ratings Affect Retail Sentiment

The narrative is determined by institutional research. High-quality companies that promote upgrades can provoke retail purchases in social networks such as Reddit or Robinhood.

The Role of Large Funds and Quant Models in CEP Target Consensus

Huge funds can move at a quicker pace to do research, which is read by the retail price. Target changes may also be propagated through algorithmic flows by quant models at institutions.

Media Coverage and Marketwatch Mentions – How Perception Shifts Price

Analyst moves are boosted by media coverage on MarketWatch or financial media.

Comparing CEP’s Targets With Peer SPACs and Sector Benchmarks

Benchmarking plays an important role in determining the realism of a target.

Where CEP Stands Among Financial-Tech and Equity-Service SPACs

Compare target multiple of CEP with similar deals that have taken place in fintech or crypto de-SPAC transitions. When the target of CEP suggests a premium above those of peers that had superior fundamentals, doubt the premium.

Lessons From Similar De-SPAC Transitions

A number of SPACs that had crypto treasuries performed well initially, but most of them stabilized. Use these case studies to temper optimism.

When you identify two specific peer SPACs, you can compare them against CEP using the following metrics:

| Metric | How it helps in comparison |

| Stage of lifecycle | A SPAC that has not yet identified a target is more speculative. One that has announced a merger, like CEP, faces risks related to the specific target. |

| Sponsor track record | Evaluate the sponsors’ history of successful mergers to gauge their ability to find and execute a promising deal. |

| Trust value per share | The cash held in the trust account provides a floor for a SPAC’s share price. Compare this to the current market price and redemption value. |

| Acquisition sector | Compare the industries of the target companies to understand the specific market risks and growth potential. CEP’s focus on crypto differs from many traditional SPAC targets. |

| Management and valuation | For SPACs that have announced a merger, compare the valuation and management of the new public company. Look at metrics like enterprise value (EV) and debt. |

Analyst Accuracy Tracker – Who’s Been Right on CEP So Far?

Track analysts make calls by their name. This assists in weighing the targets that should be trusted.

Ranking Analysts by Historical Forecast Accuracy

Prefer analysts who have experience regarding SPACs and crypto-related companies.

How to Interpret Revisions and Adjust Expectations

An upward revision that is repeated a number of times may reflect a kind of improving fundamentals. Repeated swings might indicate that analyst models are weak and are dependent on noisy inputs.

Investor Takeaways – How to Use Price Targets in Trading Decisions

The tools of analysts are not gospel.

Using Analyst Targets With Risk-Reward Ratios

When a target is distant to the current price, but dependent on low redemptions, sizes it conservatively.

When to Re-Evaluate Your Position Based on Analyst Sentiment

Review jobs following significant filings, redemption reports, or high profile target cluster transactions among reputable analysts.

FAQs – Analyst and Marketwatch Insights About CEP Stock

What is CEP’s current consensus price target for 2025?

The consensus targets vary. Aggregators are broadly distributed; refer to MarketWatch or Yahoo Finance as of the most current mean and median targets.

How reliable are analyst ratings for newly merged SPACs like CEP?

They cannot be as reliable as with mature firms. The SPACs are dependent on event risk, redemption chemistry and execution.

Where does MarketWatch get its analyst target data?

MarketWatch draws the information of broker reports and filings.

Why do price targets differ so much across analysts?

Various assumptions concerning redemptions, pro-forma NAV, BTC price, and dilution are used by the analysts. Minor adjustments to such inputs generate significant oscillations in result.

How often are CEP’s targets updated or revised?

The revisions are made around major events: S-4 filings, PIPE closes, shareholder votes and major market moves.

Is social chatter (Reddit/Robinhood/Twitter) influencing analyst targets?

The chat in social circles may be pressurizing the prices of the market, yet the respectable analysts make targets on models. Nonetheless, liquidity changes can be quickly revaluated by analysts due to sudden retail frenzy.

Should I follow analyst targets or the technicals (RSI/support) for CEP?

Use both. The horizon is determined by analyst targets. Technicals assist in the entry and risk management. In the case of CEP, a balanced perspective is to combine fundamentals, targets and TA.

Conclusion – What the Analyst Targets Reveal About CEP’s Future

Cep stock analyst price targets provide a framework of looking at the numerous unknowns surrounding the merger and crypto exposure.They pack assumptions of redemptions, PIPE size, BTC holding and dilution into straightforward reference points. For traders, targets help set risk-reward bands. For longer-term investors, the targets show where professional research centers its optimism or concern.

However, keep in mind that CEP is event-driven.Treat targets as hypotheses to be proved but not things to be accepted.Monitor filings, redemption counts, borrow information, and significant analyst revisions. Apply narrow risk controls, limited position sizing and an exit strategy. If you track the consensus trend, the underlying assumptions, and how the market reacts to real milestones, you will be far better placed to decide whether Cep stock fits your portfolio in 2025.