Cantor Equity Partners (CEP) has turned into a more interesting ticker to traders who monitor blank-check companies, also referred to as SPACs. As opposed to conventional operating firms, SPACs such as CEP raise funds and subsequently take private businesses public. The result of this structure is distinctive trading behavior in many cases, sentiment and speculation rather than fundamental results influence the trading.

Due to this reason, technical analysis becomes an important tool to explain CEP stock movements. The most important aspects of traders that we will explore in this guide are RSI (Relative Strength Index), support and resistance levels, and other momentum indicators that can be used to determine the direction of the price and trading opportunities. You can also get backtesting information, risk management advice and how to combine technical signals with news about deals, and so it is one of the most comprehensive CEP technical analysis sites on the Internet.

Table of Contents

Understanding CEP’s Technical DNA

It is worthwhile to know what makes CEP Stock a different entity than an ordinary equity before analyzing charts. CEP being a SPAC, does not have constant operations and earnings that anchor its price; rather, its value varies according to merger speculations, investor trust, and news cycles.

As an illustration, the RSI of CEP can move very fast in days between overbought and oversold areas. Likewise, the support and resistance levels can change rapidly since the volume clusters will be formed and dissolved faster than in established firms. The traders working with the CEP stock charts are to pay attention to multi-time frame analysis, i.e. to the analysis of daily and weekly candles, to catch the spikes in the short-term and the long-term changes in the sentiment.

Read more:CEP Stock News & Update

Key Indicators for CEP: RSI, MACD & Momentum

In the case of CEP stock, its primary indicators of interest to traders are RSI, MACD, and tools of momentum such as ADX or ROC. RSI assists in identifying overbought and oversold positions whereas MACD affirms the direction and strength of the trend. When the two are in line, such as RSI increasing with a bullish MACD crossover, it is usually an early reversal in the trend. These tools together provide clearer timing for entries and exits in CEP’s volatile price swings.

What the RSI (Relative Strength Index) Reveals

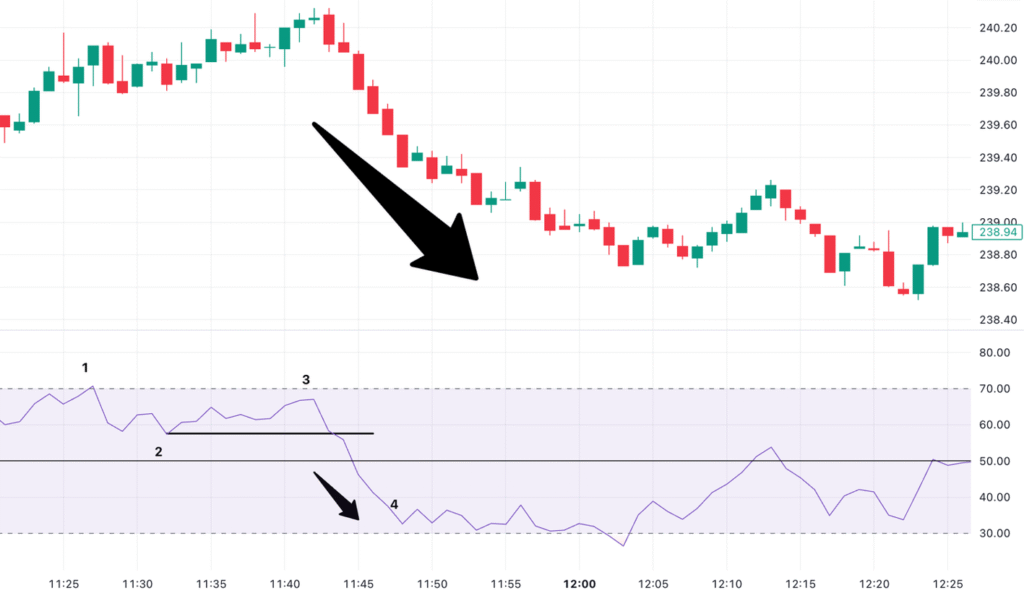

RSI is commonly used as one of the most common tools of momentum, which evaluates the overbought or oversold nature of a stock. In the case of CEP stock, RSI values of above 70 normally signify the overbought market where a reversal in the price may occur and values of below 30 signify oversold markets and possible rebounds.

However, traders should interpret RSI differently in volatile SPACs. A sharp drop in CEP’s RSI doesn’t always mean the stock is weak; it can also mean temporary panic selling before a merger announcement. Conversely, an RSI spike above 70 might reflect short-term hype rather than genuine strength. Look for RSI divergence when the RSI moves opposite to the price as this often signals a potential reversal.

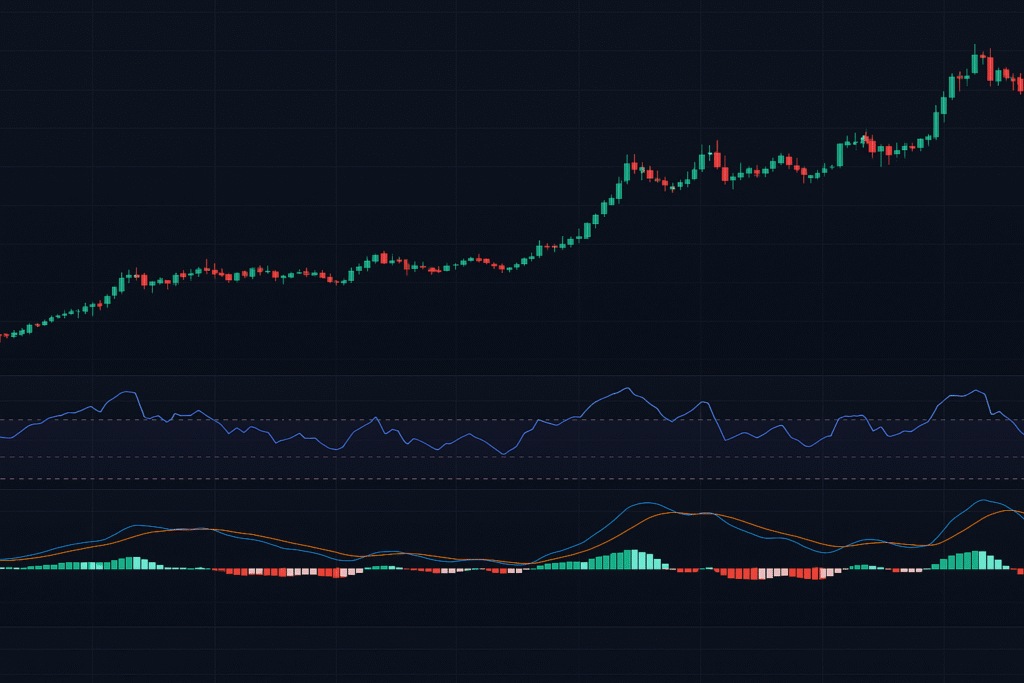

MACD & Signal Line Interaction Confirming Momentum Shifts

The Moving Average Convergence Divergence (MACD) indicator is used to support the trend direction as the RSI does. The crossing of the MACD line of CEP Stock over its signal line normally represents a bullish momentum.A cross below, meanwhile, may signal bearish sentiment. MACD histograms are especially useful in SPACs since they visually capture changing momentum earlier than RSI does.

The MACD validated the short-term rallies of CEP in the recent trading history which followed the consolidation period especially when the RSI also turned up around the 30-40 scale. Combining both gives traders stronger confirmation before entering trades.

Other Momentum Tools in the CEP Context

The technical picture of CEP can be fined with the help of such indicators as ADX (Average Directional Index) and ROC (Rate of Change). The ADX is used to gauge the strength of the trend hence when it is above 25 with a positive slope the trend that is currently in place whether bullish or bearish is strong.

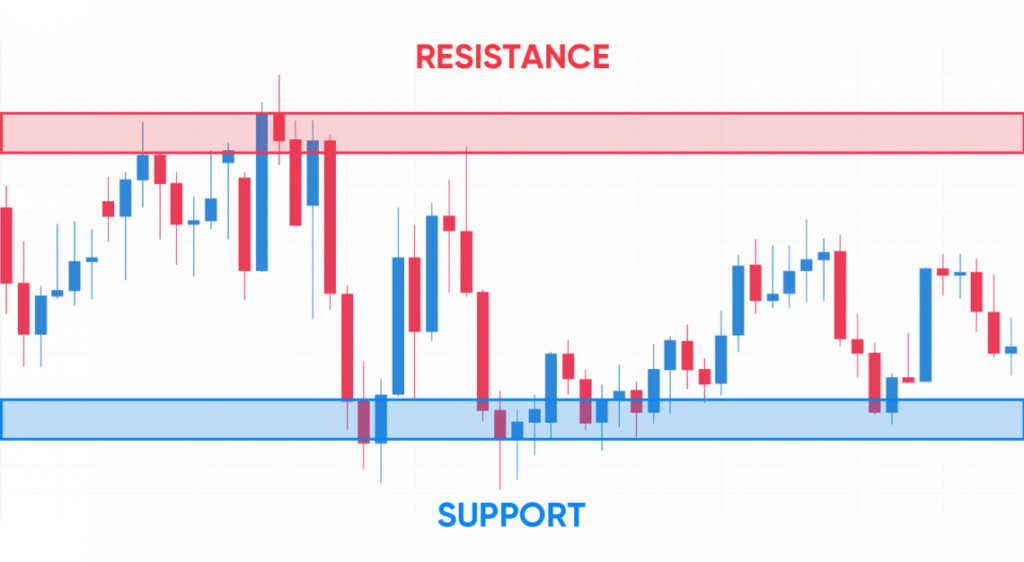

Drawing Support & Resistance Zones for CEP

Whereas most traders use pivot points, CEP stock needs a more evolving support and resistance. Instead, identifying zones – price ranges where buyers or sellers repeatedly react – gives a clearer view of market behavior.

The traders may begin by making horizontal lines around places where CEP stock has turned around or consolidated in the past.. A multi-timeframe strategy works best: use daily charts for immediate support levels and weekly charts to identify stronger zones formed over time. Also, watch for volume clusters – areas where trading volume spikes – as they often mark key price reactions.

Combining RSI with Support & Resistance for Signals

By superimposing the RSI readings of the support and resistance levels, traders are able to identify high-probability setups. An example is that when CEP RSI reaches low of less than 30 just before a stock reaches a known support area, this is usually an indication of an imminent bounce. On the other hand, when RSI exceeds 70 near a resistance area, traders should prepare for possible pullbacks.

A good example was when CEP RSI rocketed off 28, and the price was put to test a major support zone of $10.40. In days, the stock was up above 11 again . This example demonstrates how CEP stock support resistance levels and RSI alignment can create profitable opportunities.

Managing Trades: Entry, Targets & Risk Controls

It is an erratic position to manage in CEP Stocks and thus needs discipline. Best points of entry are made when RSI and price converge at the support or when RSI and price have been confirmed to have broken above resistance.For targets, traders can aim for the next resistance level or a percentage-based profit margin (e.g., 5–10%).

It is important to set stop-losses – which are normally just below the nearest support or a percentage margin below the point you entered. In the case of position sizing, the cep stock float is worth considering; it may have an impact on volatility. SPACs with smaller floats tend to have sharper price swings, requiring tighter control on trade size and risk.

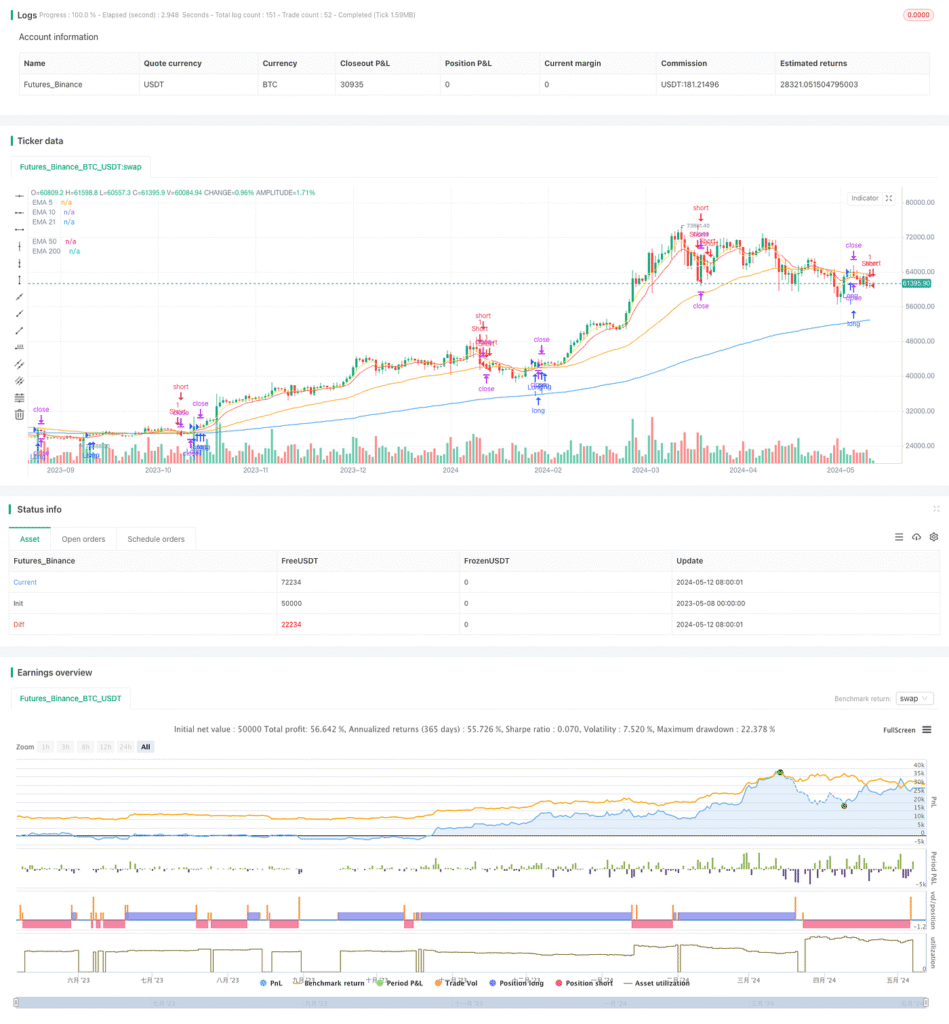

CEP Historical Bounce Patterns & Backtest Insights

Traders can use historical backtesting to know how CEP responds to support and resistance areas. By reviewing previous cycles, we can spot recurring bounce patterns. For example, when CEP approached $10.20 in past months, it often rebounded within a few sessions, confirming this as a strong support zone.

Here’s a sample backtest-style summary:

| Period | Support Tested | RSI Value | Outcome |

| Jan 2024 | $10.25 | 32 | Bounce to $11.00 |

| Mar 2024 | $10.10 | 28 | Rally to $11.30 |

| Jun 2024 | $10.35 | 30 | Reversal to $10.90 |

This historical behavior shows that technical levels often repeat, giving traders a framework for future setups.

Merging TA with Deal News: Timing for CEP

In SPACs, such as CEP Stock, technical patterns may be rudely superseded by the announcement of a merger or an SEC filing. A bullish breakout can fail instantly if a merger gets delayed, or a bearish trend can reverse sharply upon deal confirmation.

Technical and fundamental signals should be combined, and that is the best approach. As an illustration, when RSI is strong and the speculation of upcoming mergers is being built, traders may expect an up-breakout. In contrast, RSI divergence during rumor-driven rallies may suggest a temporary spike before correction.

Benchmarking CEP Against Peer SPACs

In order to find out the price dynamics of CEP Stock, it is useful to compare it to peer SPACs.

Compared to peers, CEP Stock tends to exhibit higher RSI volatility and stronger reactions to resistance tests. This may indicate that short-term traders dominate CEP’s volume. Recognizing such traits helps traders adjust their expectations and avoid overtrading low-liquidity phases.

| SPAC | RSI Range | Typical Support | Reaction Strength |

| CEP | 25–75 | $10.20–$11.20 | High |

| XYZ SPAC | 30–70 | $9.90–$10.80 | Moderate |

| ABC SPAC | 35–68 | $10.10–$11.00 | Low |

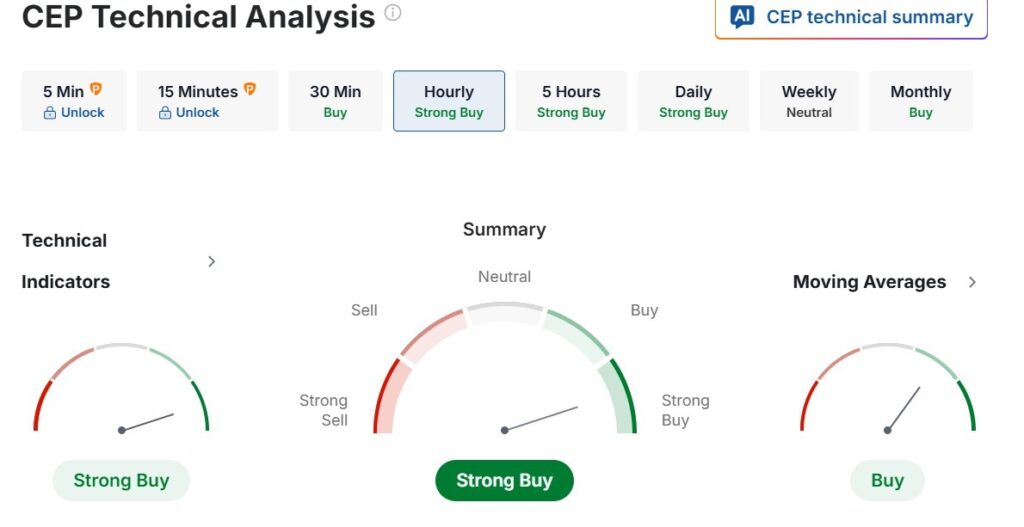

Alerts, Tools & Chart Sources You Should Use

In case of live tracking, websites such as TradingView or TipRanks or MarketChameleon would offer great charting. On TradingView, you can add your own alerts to go off when RSI goes above or below a certain value (such as 30 or 70) or when price breaks a given area.

Load essential indicators such as RSI, ADX, volume profile, and pivot levels to get a multi-dimensional view. These platforms let traders visualize both price momentum and reaction zones efficiently. (Use CEP stock chart from TradingView for visual reference.)

Summary of Technical Insights & Trade Ideas

In conclusion, the RSI analysis, when combined with support/resistance mapping, is an impressive tool to study the behavior of CEP stock. The traders are able to predict potential rebounds when the RSI is close to the oversold levels and near strong supports.

A few key reminders:

- Watch RSI near 70 for resistance-based reversals.

- Look for buying opportunities near support if RSI drops below 30.

- Confirm setups using MACD or volume clusters.

Applying these consistently helps build a disciplined trading routine for CEP stock.

Conclusion & Next Steps

TE of the CEP stock demonstrates that RSI and support/resistance rates are still effective instruments of high probability trading structures. These indicators are used in conjunction with MACD confirmation, volume studies and multi-time frame charts to decipher the volatile but rewarding patterns of CEP.

The traders are advised to periodically analyze new charts, watch news concerning deals, and modify levels as new information arises. The volatility of CEP can provide opportunities – to those who can have patience, research and good technical discipline. Keep up with our CEP stock coverage to receive regular forecasts, news, and trading insights in order to keep up with market trends.

FAQs on CEP Technical Analysis

1. What is CEP’s current RSI and what does it mean?

The RSI of CEP usually varies between 30 and 70. When the value is close to 70, it could be overbought meaning that there is limited growth potential, whereas when it is close to 30, it can be oversold and it can be rebounding.

2. Which support zone is most reliable for CEP now?

The 10.20-10.40 price range has been a powerful support level in the past. The bounces of prices at these levels usually coincide with low RSI values indicating possible buying interest.

3. How high can CEP rise based on resistance and RSI?

In case the momentum continues, and the RSI indicates it is above 50, the next resistance can be between $11.20 and 11.60.. Sustained moves above that range could open room for higher short-term targets.

4. How should I trade CEP with a stop-loss on support break?

A close stop-loss just under the important supporting area – typically 1-2 percent below – can be used to contain risk. SPACs like CEP can swing quickly, so smaller trade sizes and disciplined exits are essential.

5. Can merger news override technical signals?

Yes in SPACs like CEP, the news events can instantly change the technical arrangements.. A confirmed merger can cause a sudden breakout even if RSI is overbought, while delays may trigger sharp declines regardless of technical strength.

6. Is it safe to rely only on RSI for CEP stock analysis?

No, RSI is to be applied with the other tools such as MACD, ADX, and support/resistance mapping.